The rise of digital payments has changed how we travel—but relying solely on card payments abroad could come with unexpected financial pitfalls. A new survey by Be Clever With Your Cash, conducted in partnership with Opinium, reveals that 39% of British holidaymakers have faced situations where cash was essential and card payments simply weren’t accepted.

As the world becomes increasingly cashless, the travel industry still shows that cash remains king in many destinations, especially outside urban centres. From taxi rides to tipping and local shopping, there are still numerous occasions where having physical currency can prevent last-minute stress and hidden travel costs.

Survey: Nearly 4 in 10 Travellers Caught Off Guard Without Cash

The study paints a revealing picture of the common travel scenarios where cash is required:

- Tipping in restaurants or to hotel staff

- Independent taxi services, especially in smaller towns or rural areas

- Local street markets and small shops without card machines

- Public transport in countries where tap-and-go isn’t yet available

These findings highlight that many travellers assume cards will be accepted everywhere, only to realise the importance of carrying a small cash reserve—a so-called “cash cushion”—when it’s too late.

Hidden Costs of Emergency Cash Withdrawals

Without local currency on hand, many travellers resort to ATMs or airport currency exchanges, both of which often come with exorbitant fees and poor exchange rates.

Foreign ATM fees can range from £2 to £5 per transaction, and currency conversion fees charged by UK banks often hover around 3%. Airport exchange desks, although convenient, typically offer rates far below the market average.

These unplanned costs quickly add up, especially on longer trips, forming part of the broader issue of hidden travel costs that can derail your budget.

Expert Advice: How to Avoid Card Payment Pitfalls Abroad

Amelia Murray, money expert at Be Clever With Your Cash, offers actionable tips to help holidaymakers avoid these sneaky charges:

✅ Carry a Small Amount of Local Currency

A modest amount of local cash can go a long way—ideal for taxi rides, tips, or small purchases in places where card machines aren’t available or reliable.

✅ Check Your Card’s Foreign Transaction Policies

Many travellers assume their bank card is “travel-friendly,” only to later discover fees for currency conversion, withdrawals, or international usage. Look for fee-free cards or prepaid travel cards designed specifically for overseas use.

✅ Monitor Exchange Rates Before You Travel

Using apps or websites like XE or Revolut, keep an eye on currency trends. Converting a small sum in advance at favourable rates will give you peace of mind and save money in the long run.

✅ Use Travel Insurance Wisely

Most travel insurance policies now include cash loss coverage in case of theft or accidental loss. According to financial analysts at Defaqto, over 90% of annual policies and 86% of single-trip policies provide some level of cash protection.

- 35% of single-trip policies cover up to £299

- 24% cover between £300-£399

Make sure your policy includes this feature, especially if you’re travelling to destinations where theft is more common.

Real-World Travel: Why Cash Still Matters

Despite the digital revolution in financial services, cash remains the primary payment method in several parts of the world. For example:

- In Spain and Italy, small cafés and shops often require cash, especially in villages or markets.

- In parts of Asia, even in big cities, local vendors and tuk-tuk drivers may only accept cash.

- In the U.S., tipping culture dominates, and many service workers still prefer cash gratuities.

- In France, open-air markets and small family-run businesses frequently don’t accept cards.

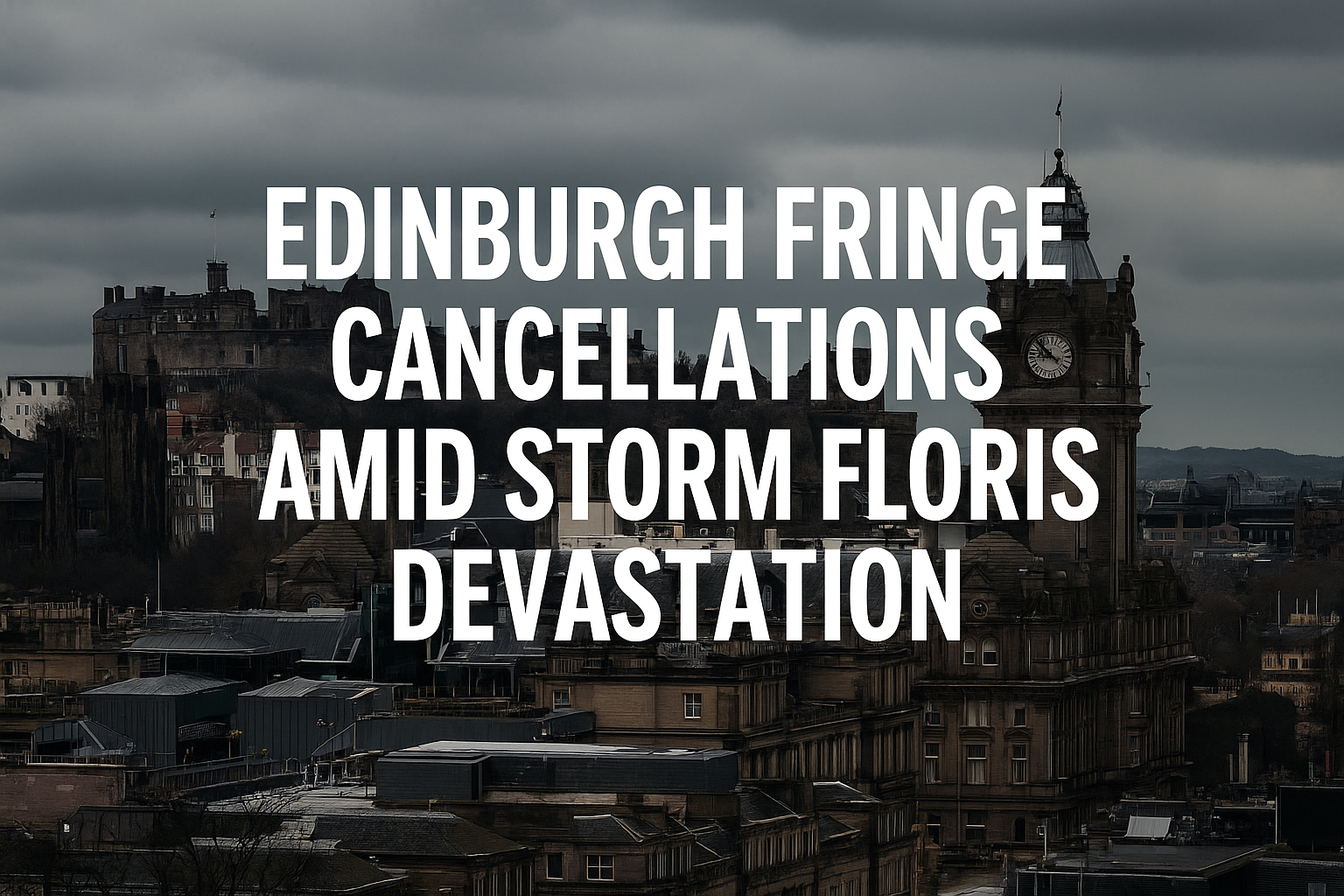

Knowing your destination’s cash habits is key to being well-prepared. Government tourism websites and destination-specific resources provide useful guidance on currency usage, customs, and local payment preferences.

The Balanced Travel Budget: Cards + Cash = Smarter Travel

While card payments offer security and convenience—particularly with contactless and app-based banking—the most successful travellers strike a balance between cash and digital methods.

- Use cards for accommodation, major transportation, and dining at international chains.

- Use cash for tips, local transit, market purchases, or spontaneous expenses.

Planning ahead ensures you won’t be left scrambling at an ATM or accepting a poor currency exchange rate at the airport desk.

Final Word: Don’t Let Fees Ruin Your Holiday

Hidden travel costs due to over-reliance on cards are an avoidable issue. By taking simple steps like understanding your card’s fees, securing a small reserve of local currency, and ensuring your travel insurance covers cash losses, you can protect your budget and enjoy your trip stress-free.

As summer travel continues to surge, make sure your financial plans are as carefully crafted as your itinerary—and don’t let hidden fees spoil your adventure.

Let me know if you’d like a social media caption, newsletter version, or printable checklist for travellers.

For more travel news like this, keep reading Global Travel Wire