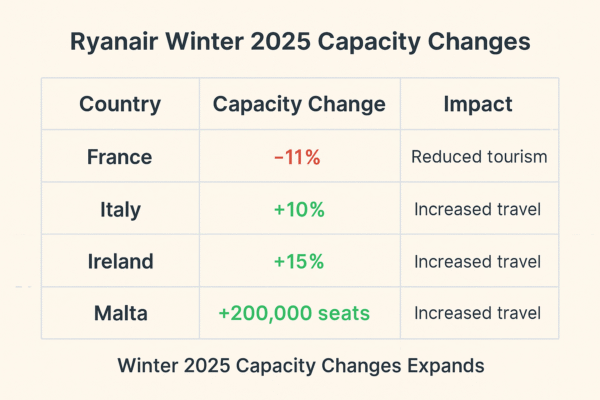

Ryanair, Europe’s leading low-cost carrier, has unveiled a new Winter 2025 capacity plan that reshapes its presence across Europe. The airline announced an 11% reduction in French flight capacity, reflecting mounting challenges such as increased aviation taxes and air traffic control (ATC) disruptions. At the same time, Ryanair is reinforcing its network in more favorable markets, increasing flights across Italy, Ireland, Spain, Malta, Belgium, and the UK.

This strategic reallocation demonstrates Ryanair’s resilience and adaptability, as the airline remains committed to maintaining growth while navigating external pressures.

France Loses Ryanair Routes Amid Aviation Tax Hike

The most immediate impact of Ryanair’s Winter 2025 restructuring will be felt in France, where the airline is cutting operations at several airports. Four airports—Strasbourg, Bergerac, Paris Vatry, and Brive—will lose Ryanair services entirely, reducing travel options for both inbound and outbound passengers.

Even at major French hubs, the cuts are significant. Paris Beauvais, Ryanair’s largest base in France, will see a reduction of 76,000 seats, while Marseille loses 58,000 seats. Airports such as Béziers, where Ryanair is the sole operator, face an even greater challenge. The airline has removed more than 100 flights, threatening local tourism and businesses reliant on seasonal travelers.

While the French government’s aviation tax reforms may boost revenue, the reduction in connectivity could affect regional tourism economies. Smaller airports—many dependent on Ryanair for passenger volumes—may struggle to offset the loss of international visitors.

Growth in Italy, Ireland, and Key Tourism Destinations

Despite the contraction in France, Ryanair is significantly expanding elsewhere in Europe. Italy, in particular, emerges as the biggest winner. Capacity will grow by 10%, adding 1.5 million seats to Italian airports. This positions Italy as a central hub for European tourism and intra-European travel, benefiting destinations from Milan to Sicily.

Ireland will also see a major boost, with a 15% capacity increase, led by Dublin Airport, which will gain nearly 600,000 seats compared to Winter 2024. This growth strengthens Ireland’s role as a vital hub for Ryanair’s network, catering to both business travelers and tourists.

Other key markets, including Spain, the UK, Malta, and Belgium, also benefit from capacity shifts. Airports such as London Stansted, Brussels Charleroi, Alicante, Krakow, and Malta International Airport will each gain over 200,000 additional seats, reinforcing Ryanair’s dominance in these regions.

Airport-Level Winners and Losers

The redistribution of Ryanair’s Winter 2025 capacity highlights both winners and losers across the continent:

- Winners:

- Brussels Charleroi (+200,000 seats): Boosting Belgium’s inbound tourism.

- London Stansted (+200,000 seats): Supporting UK growth in leisure and business travel.

- Alicante (+200,000 seats): Strengthening Spain’s role as a winter tourism hotspot.

- Malta (+200,000 seats): Expanding connectivity for Mediterranean tourism.

- Krakow (+200,000 seats): Driving Eastern European inbound growth.

- Losers:

- Paris Beauvais (-76,000 seats): A major setback for France’s inbound tourism.

- Marseille (-58,000 seats): Reduced connectivity for southern France.

- Béziers (-100+ flights): A blow to local tourism-dependent economies.

Ryanair’s Flexibility: A Key Competitive Advantage

With 93 operating bases across Europe, Ryanair retains a unique ability to reposition aircraft quickly in response to changing market conditions. This flexibility allows the airline to avoid higher-cost markets like France while maximizing returns in regions offering stronger growth prospects.

By adding 31,000 extra flights and six million more seats overall compared to last winter, Ryanair is not contracting—it is strategically optimizing. This agility reinforces its role as Europe’s dominant budget carrier, capable of adjusting its network in ways many competitors cannot.

Economic Impact on Tourism

The reduction in French services may have long-lasting effects on regional tourism and economic development. For destinations like Strasbourg and Bergerac, losing Ryanair flights reduces accessibility for foreign visitors, particularly budget travelers from the UK, Ireland, and Germany. This could impact hotels, restaurants, and cultural attractions reliant on international tourism.

On the other hand, destinations such as Italy, Malta, and Spain stand to benefit enormously. More inbound seats translate into greater accessibility, which often results in higher tourism numbers. According to the European Travel Commission, seat availability is one of the strongest drivers of short-haul tourism flows, suggesting these destinations could see a winter tourism boom.

Broader Lessons for European Aviation

Ryanair’s Winter 2025 adjustments reflect a wider trend in the aviation industry: airlines are prioritizing flexibility over rigidity. Rising taxes, regulatory changes, and operational disruptions are pushing carriers to reallocate resources rapidly to maintain profitability and passenger growth.

For travelers, this shift means expanded flight options and competitive fares in growing markets such as Italy, Spain, and Malta—but reduced accessibility and fewer budget options in France.

Conclusion: A New Balance for Winter Travel

Ryanair’s Winter 2025 schedule adjustments demonstrate both the airline’s strategic foresight and its ability to adapt quickly to shifting market conditions. While French travelers face fewer options, other European markets benefit from expanded access, affordable fares, and greater tourism opportunities.

As Europe heads into the winter season, Ryanair’s network realignment reinforces its role as the leading force in European budget travel, shaping the future of tourism flows across the continent.

For more travel news like this, keep reading Global Travel Wire