As global travel rebounds post-pandemic, Singapore has introduced a set of refreshed customs regulations for 2025 that directly affect how international travelers declare and manage goods at entry points. Aimed at reinforcing tax transparency and protecting domestic economic interests, these updated rules focus primarily on Goods and Services Tax (GST) exemptions, customs declarations, and penalties for non-compliance.

Given Singapore’s position as a premier transit and tourist destination in Asia, the new framework is already reshaping traveler behavior—particularly in relation to shopping and souvenir imports.

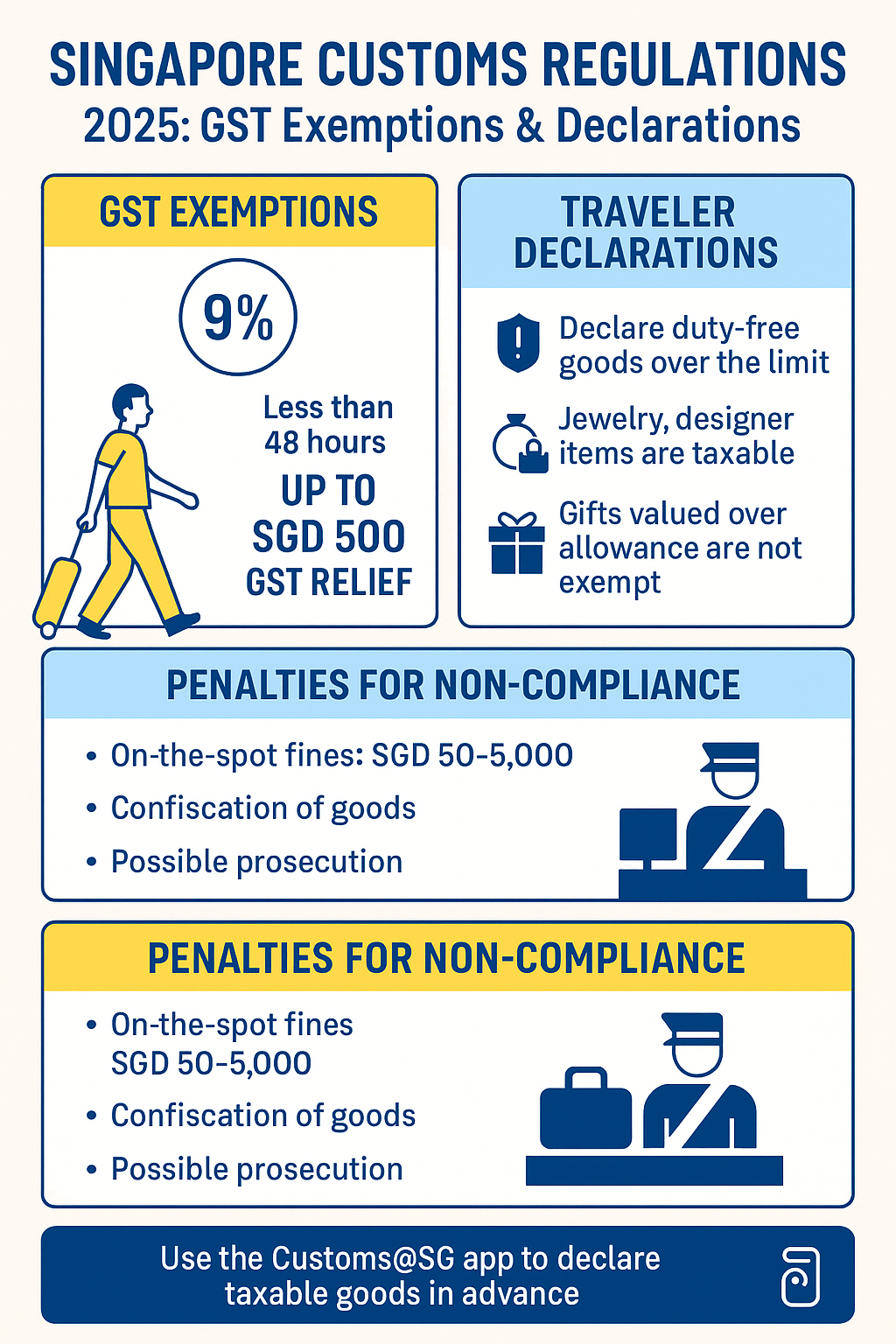

GST Now at 9%: Relief Limits Based on Duration Abroad

Singapore’s Goods and Services Tax (GST), currently set at 9%, is applied to all goods imported into the country, including those brought in by tourists. However, Singapore does provide a GST import relief allowance, with thresholds determined by the duration of the traveler’s overseas stay.

- Travelers abroad for 48 hours or more can enjoy GST relief on goods worth up to SGD 500 (~USD 370).

- Travelers abroad for less than 48 hours are eligible for a significantly reduced exemption of only SGD 100(~USD 75).

It’s important to note that this exemption excludes restricted items such as alcohol, tobacco, and petroleum-based products. These goods remain subject to full taxation regardless of the travel duration.

What Happens If You Exceed the Limit?

When the value of goods brought into Singapore exceeds the permitted GST-free allowance, travelers must declare the excess upon arrival—or risk penalties, which may include fines, confiscation, or even prosecution.

Singapore Customs has ramped up enforcement efforts across Changi Airport, land checkpoints, and sea terminals, with nearly 200 travelers penalized in recent months. Violations include non-declared luxury items, alcohol, tobacco, and collectible goods such as Pop Mart toys, which have become increasingly popular among travelers from neighboring Asian countries.

Common Pitfalls: What Tourists Forget to Declare

Experts say many violations occur due to misconceptions about what constitutes dutiable goods. Items like:

- Branded handbags

- Designer clothing

- Jewelry

- Electronics

- New or lightly used shoes

…are often wrongly assumed to be personal items exempt from tax if used during the trip. In reality, new or second-hand goods purchased abroad must be declared, regardless of whether they were worn or unboxed before return.

Dr. Lynda Wee, a retail and customs expert at Nanyang Technological University, clarified:

“Removing tags or using an item doesn’t exempt it from declaration. Only items that were owned and used prior to travel qualify as personal belongings.”

Don’t Forget the Gifts—They’re Taxable Too

Another grey area involves gifts received overseas. Many tourists mistakenly assume gifts are GST-free due to lack of receipts. However, Singapore Customs mandates declaration of all items above the relief threshold, including gifts. Officers may estimate value using comparable goods if receipts are unavailable.

Kor Bing Keong, GST leader at PwC Singapore, advised that digital receipts, emails, or payment screenshots can help avoid disputes during inspection.

Digital Customs Declarations via Customs@SG App

To simplify the declaration process, Singapore Customs offers the Customs@SG mobile app, which allows travelers to:

- Declare taxable goods before arrival

- Calculate GST dues

- Make digital payments

- Receive faster clearance at immigration counters

Travelers are strongly encouraged to use the app for efficiency and transparency, particularly when carrying high-value items.

Pro Tip: Pack any dutiable goods separately and keep them at the top of your luggage for easier inspection.

Penalties for Non-Compliance: What You Risk

Travelers who fail to declare dutiable goods face strict enforcement:

- On-the-spot fines ranging from SGD 50–SGD 5,000

- Confiscation of goods

- Referral to prosecution for repeat or severe violations

Singapore Customs continues to monitor trends in traveler behavior and has increased spot checks, especially on flights arriving from shopping-heavy destinations such as Bangkok, Tokyo, and Dubai.

Implications for Global Travelers and the Tourism Sector

For international tourists, the implications extend beyond just extra costs. The rising enforcement reflects a broader global trend of tightening customs regulation amid increased cross-border spending.

Tourists may now:

- Shop more cautiously abroad

- Prioritize experience-based travel over retail therapy

- Opt for services (wellness, tours, cuisine) over products

- Avoid bulky or branded luxury items that trigger scrutiny

For Singapore’s tourism industry, this trend could shift the balance of spending toward entertainment, hotels, and events, rather than duty-free and luxury retail.

Travel Industry’s Role: Awareness and Adaptation

Tour operators, airlines, and travel agencies are now taking steps to educate travelers about Singapore’s customs regulations. In-flight announcements, booking-site disclaimers, and informational leaflets are being explored as preventive measures.

Singapore’s proactive move also signals a push toward a digital-first customs clearance experience—a model other countries may soon emulate.

Final Takeaway: Declare Smart, Travel Stress-Free

As Singapore modernizes its customs policies, the message to global travelers is clear: Be proactive, declare honestly, and use the Customs@SG app to avoid surprises.

With the summer season underway and thousands expected to pass through Changi Airport daily, informed and compliant travelers can ensure smoother transitions—and contribute to Singapore’s vision of a safe, transparent, and efficient global gateway.

For more travel news like this, keep reading Global Travel Wire