Carnival Corporation’s Strategic Fleet Realignment in 2025: A Move Towards Efficiency and Innovation

Miami, Florida – June 2025 — Carnival Corporation, one of the world’s largest leisure travel companies, is realigning its cruise portfolio with a strategic sale of two of its vessels: the luxury Seabourn Sojourn and the iconic Costa Fortuna. This move signals a broader initiative to modernize the fleet, enhance sustainability, and realign brand positioning across key markets.

The Seabourn Sojourn will transition to Japan’s Mitsui Ocean Cruises in 2026, while the Costa Fortuna is set to relaunch under the Margaritaville at Sea brand in late 2026. These decisions reflect Carnival’s long-term strategy of maintaining a modern, high-yield fleet by divesting older ships and focusing on next-generation vessels.

Seabourn Sojourn Sails into New Waters with Mitsui Ocean Cruises

The Seabourn Sojourn, known for its ultra-luxurious design and elite clientele, will soon become part of the Mitsui Ocean Cruises fleet. The ship, celebrated for its boutique-style offerings and personalized service, has played a critical role in Seabourn’s portfolio. However, its sale represents a calculated step in Carnival’s broader optimization strategy.

According to Carnival’s executives, the sale was not prompted by underperformance but rather part of a deliberate initiative to maintain a leaner and more efficient luxury offering. With new luxury ships already in the pipeline, Carnival is confident that the exit of Seabourn Sojourn will not hinder the company’s market share in the premium segment.

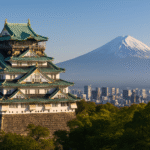

Mitsui Ocean Cruises, which has been expanding its luxury offerings in Asia, is expected to refurbish the vessel to align with Japanese luxury travel expectations, further elevating its appeal in regional markets.

Costa Fortuna Heads to Margaritaville, Costa Serena Steps Up in Europe

The Costa Fortuna will transition to the Margaritaville at Sea fleet, a move that underscores Carnival’s strategy of brand diversification and regional specialization. The transition is scheduled for late 2026, marking a shift in the vessel’s demographic focus—from European family travel to laid-back Caribbean and Bahamian voyages.

Carnival’s CEO, Josh Weinstein, reassured stakeholders that Costa Cruises will retain a strong footprint in Europe. The Costa Serena, another capable and popular ship within the Costa fleet, will take over the Fortuna’s itineraries and routes in the European market.

“Costa remains our leading brand in Europe, and the Serena’s deployment will ensure uninterrupted service to our valued guests across the continent,” Weinstein emphasized during a recent earnings call.

This seamless substitution helps Carnival preserve operational consistency while leveraging the brand equity of Margaritaville in the North American market.

Financial Strategy and Above-Book Value Sales

While Carnival did not disclose exact figures for the vessel sales, Chief Financial Officer David Bernstein confirmed that both ships were sold “nicely over book value.” The financial upside, coupled with the ability to reallocate capital toward higher-yield ships, reinforces the strategic nature of the decision.

“These sales are not about reducing capacity—they’re about increasing efficiency and building a future-focused fleet,” Bernstein noted. “We’re constantly approached by cruise operators looking for solid ships, and when the offer aligns with our long-term goals, we act.”

Carnival plans to reinvest the proceeds in next-generation, environmentally efficient ships that align with emerging trends in cruise travel, including green propulsion technologies, smart energy management systems, and enhanced guest digital experiences.

Driving Towards a Sustainable Future

This reshuffle is also part of Carnival’s sustainability strategy, which seeks to reduce the carbon footprint per passenger while enhancing onboard guest satisfaction. Older vessels, even with refurbishments, typically do not meet the performance benchmarks set by new green cruise ships entering the market.

By releasing these two ships, Carnival gains greater operational agility to deploy vessels equipped with liquefied natural gas (LNG) engines, waste-to-energy systems, and advanced wastewater treatment capabilities.

The fleet modernization comes amid growing demand for sustainable cruise options, particularly from eco-conscious travelers in Europe and North America. As global regulations tighten, Carnival’s proactive stance is expected to deliver both environmental benefits and long-term shareholder value.

Carnival’s Forward-Looking Strategy

Carnival continues to evolve as a market leader in the global cruise industry by making bold, future-facing decisions. These ship sales not only streamline the fleet but also set the stage for a new generation of cruise experiences—more luxurious, more efficient, and more environmentally conscious.

With over 90 ships across its brands, Carnival Corporation’s ability to pivot with market trends is a major strength. Its multi-brand model—including Carnival Cruise Line, Princess, Holland America Line, AIDA, Costa, and Seabourn—allows for diversified regional growth without compromising individual brand identity.

By aligning its assets with market demand, Carnival is laying the foundation for sustainable growth while catering to evolving traveler preferences—from luxury seekers to budget cruisers and adventure travelers.

Conclusion: A Strategic Course Correction for Global Cruise Leadership

Carnival’s 2025 decision to sell the Seabourn Sojourn and Costa Fortuna is more than a financial transaction—it’s a signal of a well-calibrated transformation. As the cruise industry regains momentum post-pandemic, Carnival is positioning itself not just to recover but to lead. The redeployment of capital into more efficient, sustainable, and guest-centric ships ensures that the company will remain a dominant player on the high seas for years to come.

For more travel news like this, keep reading Global Travel Wire