Spain, one of the world’s most visited destinations, is bracing for a challenging summer despite projections that international tourist arrivals may reach 100 million in 2025. While visitor numbers are expected to break records, tourism revenue growth is forecasted to slow significantly, raising concerns across the global airline and travel sectors.

Driven by global economic instability, high inflation, reduced consumer spending, and tariff tensions—especially between the U.S. and Europe—Spain’s hospitality and aviation sectors are facing a difficult summer season. Tourists may not be spending as freely, and the cost of air travel is deterring middle-income travelers from long-haul trips.

Economic Uncertainty and Its Global Ripple Effect on Travel

The slowdown in Spain’s travel revenues is a reflection of a broader global economic downturn. Airlines worldwide are reporting similar patterns—especially on transatlantic routes—citing challenges such as fuel price volatility, inflation, and revised route strategies.

Major U.S. airlines including Delta Air Lines, American Airlines, and United Airlines have begun to scale back their European operations due to falling demand, with Spain among the destinations most affected. Higher airfare, coupled with softening corporate and leisure travel, is prompting these carriers to reduce frequencies or pause less profitable routes to cities like Madrid, Barcelona, and Malaga.

European Airlines See Demand Dip Across Spain Routes

European carriers are also grappling with declining travel demand to Spain from their core markets in Germany, France, and the United Kingdom. Airlines such as Lufthansa and Air France-KLM have acknowledged that revenue from leisure-heavy Spain routes has dropped, largely because of travelers opting for shorter, regional trips or skipping international travel altogether.

Even budget airlines like Ryanair, Vueling, and EasyJet—which rely heavily on Spain’s short-haul and mid-haul markets—are adjusting their forecasts. With passengers becoming more price-sensitive, rising airport fees, fuel costs, and airfare hikes are putting pressure on load factors and margins.

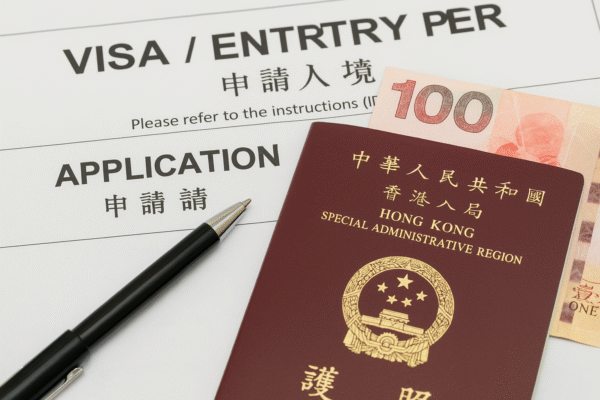

Tariff Tensions and U.S.-Spain Travel Costs

Airlines serving the transatlantic market are also caught in the middle of ongoing trade negotiations between the United States and the European Union. The uncertainty over potential tariffs on aircraft and airline-related goodshas driven up operational costs, which are ultimately passed on to travelers.

This is especially concerning for U.S. airlines flying routes to Spain, where fare increases are deterring price-conscious tourists, particularly families and younger travelers. Despite promotional efforts and flash sales, companies like Delta and American Airlines are still seeing declining bookings on Spain-bound flights.

Route Adjustments and Strategic Cuts on Long-Haul Flights

Faced with subdued demand and shifting traveler behavior, global airlines are now adjusting their route networks. Flights to Madrid and Barcelona—typically among the busiest summer routes—are being scaled back or consolidated to avoid underperforming schedules.

Even Gulf carriers like Emirates, Qatar Airways, and Turkish Airlines, which serve Spain via long-haul routes, are reportedly evaluating capacity cuts. Slower inbound travel from Asia and the Middle East—traditionally key markets for Spanish tourism—has also been observed, particularly among luxury and business-class travelers.

Spain’s Role in Airline Profitability

Spain’s status as a tourism powerhouse makes it a critical market for airlines operating in and out of Europe. National carrier Iberia, part of the International Airlines Group (IAG), is especially exposed. The carrier’s profitability depends heavily on inbound travel from Latin America, North America, and Western Europe—all regions affected by current economic uncertainty.

As tourism spend softens, Iberia and Vueling, both IAG subsidiaries, may need to adjust capacity, reprice services, and rethink market strategies. Budget travelers choosing alternative destinations or closer-to-home getaways may weaken the profitability of Spain-bound flights, which have traditionally benefited from strong seasonal demand.

Domestic and Regional Travel Gains Ground

In response to high airfare and economic pressures, tourists are shifting preferences toward regional and domestic travel. Shorter trips within Spain or neighboring European countries have gained popularity, offering affordability and fewer travel uncertainties.

This presents a challenge to international-focused airlines, while opening up opportunities for regional operators like Air Europa and domestic rail alternatives like Renfe. Spain’s robust high-speed rail network is absorbing some of the demand shift, especially on routes like Madrid-Barcelona or Seville-Valencia.

What Travelers Should Expect in Summer 2025

Tourists planning trips to Spain in the coming months should prepare for:

- Higher airfares, especially on long-haul and transatlantic flights

- Limited availability on certain routes due to reduced airline capacity

- Potential delays or cancellations on underbooked or seasonal routes

- More competition for domestic accommodation and services due to regional travel preferences

For those still planning to visit Spain, booking early, monitoring flight price alerts, and being flexible with travel dates can help offset rising costs.

Conclusion: Travel Outlook Tied to Economic Winds

While Spain is expected to welcome record-breaking tourist numbers in 2025, economic turbulence is softening the financial gains for its tourism and aviation sectors. Global airlines, especially those operating long-haul routes to Spain, are being forced to adapt to new realities: travelers are spending less, flights are more expensive to operate, and consumers are rethinking international travel.

The ripple effects are being felt across the travel industry, from airfare pricing and route availability to consumer behavior and tourism spending. Airlines must remain agile—restructuring networks, managing costs, and finding value in regional routes—while travelers will need to navigate a landscape defined by uncertainty and evolving preferences.

As Spain’s tourism economy adapts, one thing remains certain: economic trends are now as much a factor in travel as sunshine and beaches.

For more travel news like this, keep reading Global Travel Wire