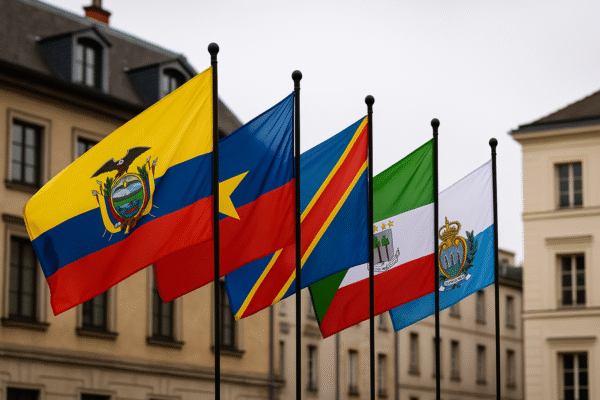

Air India, now operating under Tata Group ownership, has confirmed the resumption of flights from London Gatwick to Amritsar and Ahmedabad beginning in the Winter 2025–2026 season. These destinations, both deeply tied to the Indian diaspora in Britain, highlight the airline’s commitment to serving high-volume ethnic travel markets. The services will allow Air India to re-establish visibility in communities that rely heavily on direct links to Punjab and Gujarat.

This move reflects the carrier’s ongoing effort to strengthen connectivity between India and the UK, a market that continues to see consistent passenger demand. Despite the challenges of fluctuating yields, these point-to-point routes remain important for brand presence and diaspora loyalty.

Why Goa Was Left Out

Notably, Air India has chosen not to bring back its London Gatwick–Goa route. Goa, long regarded as a popular leisure destination, has struggled to sustain year-round profitability due to seasonality and high price sensitivity among travelers. While the coastal state attracts strong winter holiday traffic, demand tends to weaken outside the peak season.

The suspension underscores the careful balance the airline must maintain in deploying its limited widebody aircraft. With a growing fleet modernization program underway, Air India has prioritized markets with stronger yields and less volatility over routes dependent on seasonal leisure flows.

Maximizing Fleet Efficiency

The decision highlights Air India’s broader strategy of fleet optimization. Operating long-haul routes requires careful alignment between aircraft availability, market strength, and profitability. By focusing on Amritsar and Ahmedabad from Gatwick, the carrier ensures that critical diaspora markets remain served, while redeploying capacity away from lower-yield segments.

Goa may not be gone forever, however. The carrier has signaled that flexibility remains a cornerstone of its strategy. If future market conditions improve, Goa could be reinstated, backed by better aircraft utilization and more sustainable demand.

New Opportunities in the UK Market

Looking ahead, Air India is eyeing new opportunities to expand its UK footprint. Among the most prominent prospects is a potential non-stop service between Delhi and Manchester. The UK’s second-largest metropolitan area has a growing demand for direct links to India, particularly for business and visiting friends and relatives (VFR) traffic.

Currently, rival carrier IndiGo is planning to launch Delhi–Manchester flights with Boeing 787-9 aircraft by late 2025. If Air India acts quickly, it could establish an early presence on the route, leveraging its strong Delhi hub and extensive Southeast Asia connections to attract both point-to-point and transit passengers. This strategy would allow the airline to diversify beyond London and better capture the demand of northern England.

Expanding Into Leisure Markets Beyond Goa

While Goa may no longer feature in Air India’s Gatwick operations, the airline is actively evaluating new leisure-focused destinations. One key opportunity is the Mumbai–Denpasar (Bali) route. Bali’s consistent popularity as a year-round tourist destination offers a more stable demand profile compared to Goa.

In 2024, over 145,000 passengers traveled between Mumbai and Bali, primarily via connecting flights. Launching a non-stop service would position Air India as the first full-service carrier to capture this lucrative market. The route also appeals to premium travelers seeking direct connectivity and comfort—segments that align well with Air India’s long-haul service model.

IndiGo is expected to enter this market by 2026, but Air India could gain a decisive advantage by acting earlier. With Bali’s growing appeal as a global leisure hub, such a move would diversify Air India’s portfolio and strengthen its competitive position in Asia.

Balancing Growth and Profitability

The recalibration of Gatwick services demonstrates Air India’s adaptability in a competitive global aviation landscape. Instead of spreading its resources thinly across multiple leisure and diaspora markets, the carrier is opting for a targeted approach—sustaining essential diaspora links while pursuing higher-yield opportunities.

This strategy is aligned with the airline’s larger transformation under the Tata Group, which has focused on modernization, service improvement, and better profitability across international operations. By adjusting its network proactively, Air India is positioning itself for long-term resilience and growth.

Looking Ahead: A Dynamic Route Network

Air India’s future success in international markets will depend on its ability to remain flexible and opportunistic. While the reinstated Gatwick services to Amritsar and Ahmedabad strengthen diaspora connectivity, the airline’s eyes are firmly set on new frontiers such as Manchester and Bali.

The combination of diaspora traffic, premium business routes, and sustainable leisure destinations will define Air India’s global presence in the coming years. The suspension of Goa may appear as a setback, but it is better understood as a strategic shift—one that clears the path for routes with stronger financial and market potential.

As Air India continues its modernization journey, the Gatwick strategy is just one chapter in a larger story of transformation, where adaptability, foresight, and market responsiveness remain the keys to success.

For more travel news like this, keep reading Global Travel Wire