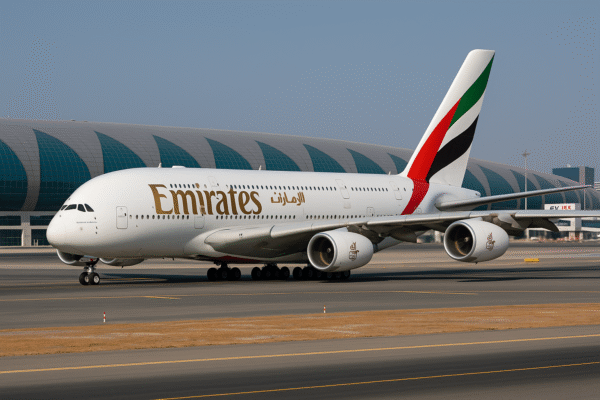

In a decisive move that underlines its unwavering commitment to long-haul aviation, Emirates has acquired four Airbus A380 aircraft for a total of $178 million. Previously leased from Guernsey-based investment firm Doric Nimrod Air Three, the aircraft have been in service with Emirates since their delivery in 2013. The ownership transfer is set to take place between August 25 and November 14, 2025, following scheduled maintenance, as confirmed by Doric’s official investor filings and Emirates’ internal fleet planning reports.

This strategic acquisition marks a significant chapter in Emirates’ fleet development and long-term network planning. The Dubai-based airline is already the world’s largest operator of the Airbus A380, and this deal reinforces its commitment to retaining the superjumbo in commercial service until at least 2040.

A Bold Commitment to the A380

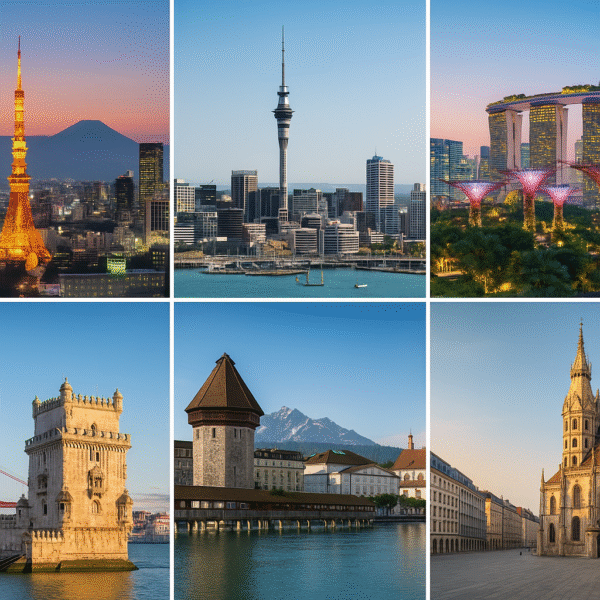

While other global carriers like Air France and Lufthansa have phased out or grounded their A380s due to operational costs and shifting fleet priorities, Emirates continues to double down on its role as the world’s leading A380 operator. With 116 A380s currently in its fleet—nearly half of all A380s ever built—Emirates continues to fly them on high-density international routes including London Heathrow, Sydney, and New York JFK.

The four aircraft included in this latest acquisition were delivered in 2013 and configured in a premium three-class layout accommodating up to 489 passengers. The cabin design features 14 First Class suites, 76 Business Class lie-flat seats, and 399 Economy Class seats—one of the most spacious and comfortable widebody layouts in the skies.

According to aviation data provider ch-aviation, the aircraft have accumulated between 40,000 and 43,000 flight hours and around 5,000 flight cycles each. Despite their age, Emirates’ ongoing investment in interior refurbishment and advanced in-flight services ensures they remain highly competitive on long-haul routes.

Why Emirates Bought Instead of Renewing Leases

The purchase from Doric Nimrod Air Three marks a calculated financial decision. Leasing costs for large aircraft such as the A380 can fluctuate widely based on interest rates, maintenance obligations, and residual value uncertainty. By taking ownership, Emirates eliminates future lease payments, avoids volatility in aircraft lease markets, and gains complete control over aircraft usage, refurbishment, and retirement timelines.

According to investment disclosures, each aircraft acquisition includes an estimated $25 million purchase value plus $20 million per plane to meet return conditions, further affirming Emirates’ financial confidence in maintaining the aircraft through 2040.

The Bigger Picture: Emirates’ Long-Term Fleet Vision

This acquisition is consistent with Emirates’ broader fleet modernization strategy. While the airline continues to invest in next-generation aircraft, including Boeing 777-9s and 787-10s, the A380 remains a cornerstone of its global capacity offering. With over 60 million passengers having flown on Emirates A380s since their debut, the aircraft continues to offer brand differentiation in a highly competitive market.

Sheikh Ahmed bin Saeed Al Maktoum, Chairman and Chief Executive of Emirates Airline & Group, has previously stated that the airline’s “flagship A380s are loved by customers and remain a core part of our long-haul strategy.” The airline also has an extensive retrofit program underway for selected A380s, upgrading cabins with premium economy seats and enhanced in-flight entertainment systems.

In contrast to global trends of downsizing fleets for fuel efficiency, Emirates has optimized its network to suit the scale and luxury of the A380. Routes like Dubai to London, Paris, and Melbourne consistently show high passenger volumes, justifying the aircraft’s continued operation well into the next decade.

Impact on Global Aviation

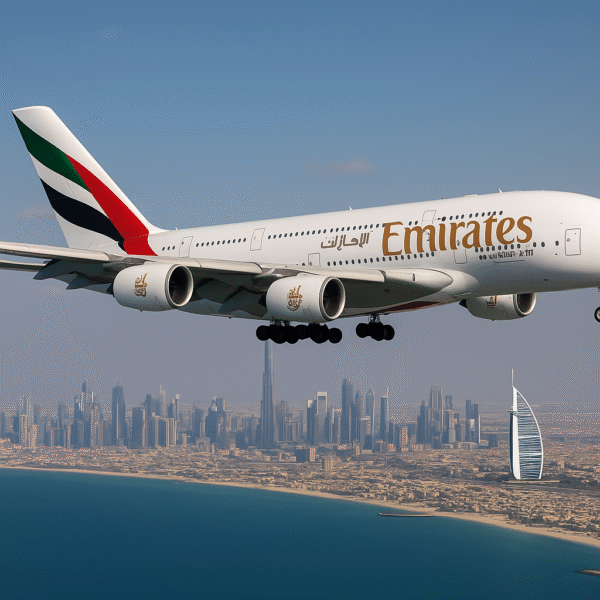

With rising fuel costs and environmental pressures prompting other airlines to reconsider large aircraft operations, Emirates’ decision to keep the A380 operational sends a strong signal. It reflects both the airline’s robust financial health and the continuing relevance of high-capacity aircraft in certain global markets.

The airline’s acquisition also highlights the growing importance of ownership flexibility in a post-pandemic world. Airlines that own their fleet outright can better manage capacity, resell aircraft, or convert them for alternative use, giving them an edge over competitors locked into rigid lease terms.

Looking Ahead: Emirates at the Forefront

As Emirates positions itself for a future marked by both high passenger volumes and elevated service expectations, investments like this A380 buyout illustrate the airline’s resolve to maintain its leadership in global aviation. With Dubai International Airport (DXB) consistently ranking as one of the busiest hubs in the world, especially for international travelers, maintaining a high-capacity, comfortable fleet is not just an operational decision—it’s a strategic necessity.

The purchase of these four A380s may be a single transaction on paper, but it marks a broader intent by Emirates to remain the global benchmark for long-haul luxury, convenience, and connectivity well into the 2040s.

For more travel news like this, keep reading Global Travel Wire