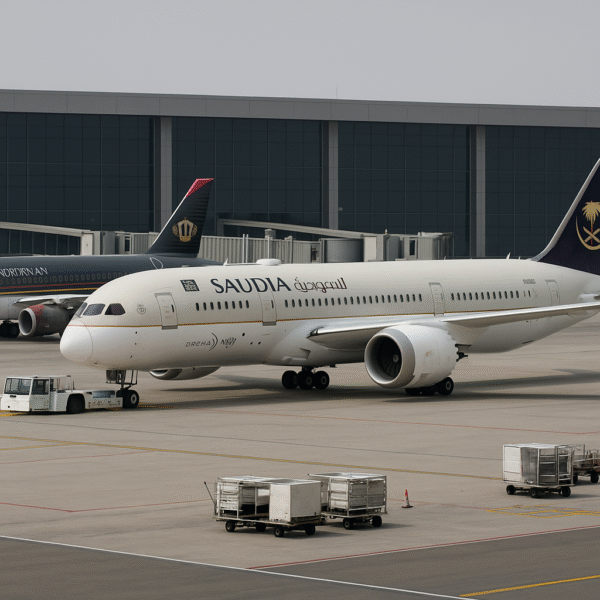

In 2025, Lufthansa has triumphantly secured its position as Europe’s most formidable airline, delivering a transformative boost to tourism across the continent. With an expansive fleet of 735 aircraft and an unprecedented order backlog of 242 new jets, Lufthansa is outpacing competitors and strengthening its network like never before.

What sets Lufthansa apart is not just scale but strategy. The airline’s six powerful hubs—Frankfurt, Munich, Zurich, Vienna, Brussels, and Rome Fiumicino—work in concert to funnel passengers from a myriad of European cities toward global destinations. This interlinked network efficiently enables seamless transfers and highly competitive connectivity, positioning Lufthansa as the backbone of European air travel.

In the second quarter of 2025, the Lufthansa Group welcomed 37 million passengers, underlining its robust market reach. With fleet expansion underway and modern aircraft arriving every two weeks, it continues reshaping the competitive landscape and reinforcing its tourism infrastructure.

A Glimpse at Competitors

Air France–KLM Group, anchored at Paris Charles de Gaulle and Amsterdam Schiphol, carried around 27.3 million passengers in Q2 2025, with a combined fleet of 590 aircraft. While Air France remains strong in Francophone Africa, its hub system and future order size are more modest compared to Lufthansa’s widespread infrastructure.

Ryanair, Europe’s low-cost giant, transported an impressive 58 million passengers in the same period. With about 620 aircraft and a vast network focusing on secondary airports and ultra-low fares, it remains the go-to for budget-conscious travelers. However, Ryanair lacks the intercontinental reach and hub consolidation that Lufthansa offers.

Turkish Airlines stands out with extensive global coverage—serving nearly 290 destinations across 124 countries through its mega hub in Istanbul. Its fleet of around 485 aircraft is growing thanks to large Airbus orders, but it still trails behind Lufthansa in hub integration and aircraft volume.

SAS Scandinavian Airlines, operating mostly from Copenhagen, Stockholm, and Oslo, continues its Scandinavian legacy, recently restructuring and modernizing with Airbus A320neo and A350 aircraft. Its regional focus, however, limits its capacity relative to Lufthansa’s continent-wide network.

Finnair, whose Helsinki hub bridges Europe and Asia, maintains a modern fleet including Airbus A350s, but geopolitical shifts mean strategic realignments. Its single-hub model and smaller scale position it as a niche operator compared to Lufthansa’s broader network.

TAP Air Portugal, with its Lisbon gateway linking Europe to Brazil, North America, and Africa, remains a vital bridge for Portuguese-speaking markets. Yet, its fleet size and hub reach are dwarfed by Lufthansa’s multi-hub dominance.

Why Lufthansa Leads the Tourism Charge

Across multiple indicators—fleet size, new aircraft commitments, hub reach, and innovation—Lufthansa stands in a league of its own. Its strategy combines scale with forward-looking investment, sustainability, and premium service.

- The airline’s fleet modernization, including Airbus A350s, Boeing 787-9s, and the upcoming Boeing 777X, promises enhanced comfort, lower emissions, and improved efficiency.

- The influx of 242 firm orders ensures regular reinforcements, some arriving biweekly throughout 2025, enabling responsive growth and schedule reliability.

- Sustainability is central: new aircraft offer up to 30% lower fuel consumption and carbon emissions, while initiatives like green fares and fuel-saving AeroSHARK technology underline Lufthansa’s environmental commitment.

- The six-hub system boosts tourism by offering diverse entry points into Europe, encouraging visitors to explore beyond just one or two gateway cities.

This multifaceted approach provides travelers with more direct connections, optimized transit experiences, and eco-friendly options—benefiting tourism economies across Germany, Italy, Belgium, Austria, and Switzerland. Local hotels, attractions, and services are poised for growth as Lufthansa brings more visitors through its well-orchestrated air network.

The Outlook

Lufthansa’s sweeping lead is redefining what it means to be a premier European airline. Competitors like Air France, Ryanair, Turkish, SAS, Finnair, and TAP continue to play vital roles, each with strengths in pricing, routes, or regional dominance. But the combination of Lufthansa’s fleet scale, ongoing orders, strategic hubs, and investment in modernization gives it unmatched leverage.

For travelers and tourism stakeholders alike, this means better connectivity, more destination options, and evolving standards of efficiency and service. From Frankfurt to Rome, Zurich to Vienna—tourism infrastructure across Europe stands to gain significantly from Lufthansa’s ambitious trajectory in 2025 and beyond.

For more travel news like this, keep reading Global Travel Wire