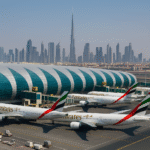

The U.S. airline industry is undergoing a recalibration in 2025, as carriers including Delta Air Lines, United Airlines, American Airlines, JetBlue, Southwest, and others scale back routes and reduce capacity amid a complex mix of softening travel demand, global economic headwinds, and changing consumer behavior. This widespread trend is reshaping both domestic and international air travel, leaving passengers with fewer options—especially on long-haul and business-heavy routes—even as fares drop across key markets.

According to the U.S. Department of Transportation (DOT) and Bureau of Transportation Statistics (BTS), while passenger numbers have shown modest gains, airline revenues are under pressure from falling ticket prices, volatile fuel costs, and weaker-than-expected business travel.

U.S. Airlines Shift Strategy Amid Changing Demand

Passenger traffic rose 3% in Q1 2025 compared to the same period in 2024, yet average domestic airfares fell by 6% in March. While consumer interest in travel remains, the industry is grappling with lower yields and overcapacity, prompting airlines to adjust flight schedules and scale back routes to protect margins.

Furthermore, U.S. travel agency air ticket sales dropped 5% year-over-year in May 2025, despite steady traveler volume, suggesting a sharp pivot toward budget carriers and discounted fare options.

Delta Air Lines: Cuts Across Key Global Markets

Delta, originally forecasting 4% growth for 2025, has revised its outlook to under 2%. The carrier is reducing international service to Germany, South Korea, and Brazil, citing weakened demand in those regions. Domestically, cuts are being made on routes out of Atlanta, Detroit, and Minneapolis, especially those reliant on corporate travel.

Delta’s cautious approach mirrors that of other carriers, with long-haul and premium-heavy routes among the hardest hit.

United Airlines: Downgraded Forecast and Route Suspensions

United Airlines has made some of the most substantial cuts among legacy carriers. The airline has lowered its 2025 revenue forecast, highlighting declines in corporate bookings and rising geopolitical risks. Routes to Tel Aviv, Shanghai, and South America have been suspended or reduced, while frequencies on key corridors like Chicago–Tokyo and transcontinental flights have been scaled back.

These changes are part of a broader move to contain costs and match capacity with real-world demand.

American Airlines: Scaling Back International and Coastal Routes

American Airlines is following suit, trimming services to key global hubs including London Heathrow, Frankfurt, and Buenos Aires. Within the U.S., New York–Los Angeles and Dallas–San Francisco frequencies have also been reduced.

As business travel continues to lag, the airline is optimizing operations and focusing on routes where leisure travel shows stronger performance.

Low-Cost Carriers Adapt to Volatile Demand

Southwest Airlines is maintaining its core U.S. network but is trimming underperforming routes in the Midwest and New England. The airline is shifting capacity to high-demand vacation destinations such as Orlando, Las Vegas, and Phoenix, with deep discounts aimed at maintaining volume.

JetBlue Airways is pivoting away from long-haul transatlantic routes, exiting Amsterdam, Paris, and London Gatwick due to profitability concerns. The airline is redirecting focus to East Coast hubs and popular Caribbean getaways like San Juan and Cancún, appealing to leisure travelers over business segments.

Ultra-Low-Cost Carriers Feel the Pinch

Spirit Airlines is withdrawing capacity from Chicago O’Hare and Baltimore, while Frontier Airlines is consolidating flights into Las Vegas, Denver, and Orlando. Although these carriers benefit from price-conscious consumers, rising fuel and labor costs are squeezing their already tight margins.

Business Travel Declines, OTAs Gain Momentum

According to the U.S. Travel Association, business travel bookings fell 8% year-over-year in May 2025, marking one of the weakest sectors in the aviation market. Many corporations continue to cut travel budgets and encourage virtual meetings over in-person engagements.

Meanwhile, online travel agency (OTA) usage is rising. Platforms like Google Flights, Kayak, and Expedia saw an 8% increase in bookings, with direct bookings reaching a record 73%—a sign of changing consumer preferences toward price transparency and itinerary flexibility.

Macroeconomic Concerns Impact Aviation Confidence

Data from the Bureau of Economic Analysis (BEA) shows early 2025 U.S. GDP contracted slightly, while inflation remains elevated. Ongoing trade tensions with China, Mexico, and Canada have weakened cross-border tourism. The University of Michigan’s Consumer Expectations Index hit its lowest level in over a decade, reflecting uncertainty that directly affects consumer travel behavior.

International inbound travel to the U.S. is also declining, with fewer arrivals from Canada and Mexico in early 2025. These reductions are forcing airlines to reevaluate global connectivity strategies, accelerating route cuts across major carriers.

TSA Numbers Hold Steady, But Risks Remain

The Transportation Security Administration (TSA) screened 904 million passengers in 2024. Early 2025 data shows stable domestic travel volumes. However, with airfare revenues falling, and booking trends softening, analysts warn that route rationalization may continue if market conditions don’t improve.

Busy hubs like Hartsfield–Jackson Atlanta (ATL), Los Angeles International (LAX), Chicago O’Hare (ORD), and Dallas Fort Worth (DFW) remain critical to airline networks but could also face capacity reductions later in 2025.

The Road to 2028: Efficiency Over Expansion

With rising costs, fluctuating demand, and global instability, airlines are shifting from expansion to resilience. The future of air travel through 2028 will be defined by targeted route optimization, cost control, and real-time response to market signals.

Expect more streamlined networks, enhanced loyalty programs, and dynamic pricing models as airlines aim to build leaner, more agile operations in an evolving travel landscape.

In sum, the widespread U.S. airline route reductions in 2025 reflect a maturing industry navigating unprecedented challenges. Travelers can expect lower fares, but fewer choices, as carriers recalibrate their strategies to remain competitive and sustainable.

For more travel news like this, keep reading Global Travel Wire