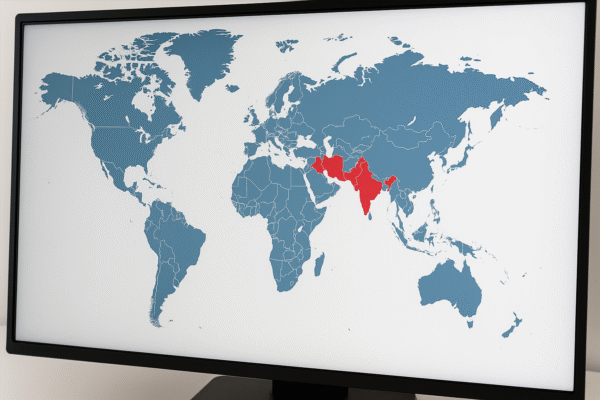

In a strategic move to counter rising travel costs and rejuvenate the struggling aviation industry, Sweden, Germany, and India have each rolled back or restructured their aviation tax regimes. These policy shifts are designed to reduce airfares, attract more travelers, and strengthen their respective countries’ positions in the global air travel market. The reforms are seen as critical to supporting economic recovery, particularly in tourism and trade, while ensuring long-term sectoral resilience.

🇸🇪 Sweden Scraps Aviation Tax to Spur Regional Connectivity

Sweden has officially announced the abolition of its controversial aviation tax as part of a broader strategy to stimulate economic activity in its remote and regional areas. The tax, which was implemented in April 2018, charged up to 517 kronor (approximately $54 USD) per ticket depending on flight distance. Initially intended to curb carbon emissions, the tax faced criticism from airlines and regional airports for discouraging travel and reducing competitiveness.

As of 2025, the Swedish government, led by Finance Minister Elisabeth Svantesson, confirmed that the tax will be eliminated entirely by Q4 2025, in accordance with the national economic revitalization program. The removal is expected to boost domestic and short-haul European travel, especially to underutilized regional airports such as Luleå, Visby, and Umeå. Authorities now aim to pursue sustainable aviation initiatives—such as biofuel investments—without penalizing passengers or airlines.

“We recognize that economic mobility and affordable travel must go hand in hand with sustainability,” said Svantesson during a press briefing in Stockholm. “Scrapping the air travel tax allows us to grow responsibly.”

🇩🇪 Germany Reverses 2024 Air Passenger Tax Hike

In another major policy shift, Germany has announced plans to reverse the 2024 hike in air passenger duty (Luftverkehrsteuer) as part of its 2026 federal budget proposal. The previous increase, introduced in May 2024, raised taxes on short-haul flights from €12.48 to €15.53 and also impacted medium- and long-haul journeys. The move drew fierce criticism from airlines like Lufthansa and Ryanair, as well as trade associations including the Federal Association of the German Aviation Industry (BDL).

The German Ministry of Finance has now confirmed that the tax rollback will take effect in early 2026, offering relief to both carriers and consumers. The reversal is projected to reduce average ticket prices by 5–7%, encourage more routes from secondary airports like Hannover and Leipzig, and make Germany a more competitive transit hub compared to neighboring countries like the Netherlands and Austria.

“Affordable connectivity is essential for our economy, and we must align fiscal policy with that reality,” said Christian Lindner, Germany’s Finance Minister.

🇮🇳 India Simplifies GST on Aircraft Parts to Cut Airfares

India, one of the fastest-growing aviation markets in the world, has taken a decisive step to simplify its complex aviation tax structure. In July 2024, the Indian Ministry of Finance announced a uniform 5% Goods and Services Tax (GST) on all aircraft and aircraft engine parts. Previously, the tax rates varied between 5% and 28%, depending on component classification, causing logistical and financial challenges for airlines.

The new structure is part of the Indian government’s broader civil aviation reform agenda, which also includes airport infrastructure development and regional connectivity schemes like UDAN. The GST rationalization is expected to reduce maintenance and procurement costs for airlines, ultimately translating into lower fares for passengers. This is especially significant for domestic carriers like IndiGo, Air India Express, and Akasa Air, which operate in highly price-sensitive markets.

According to India’s Ministry of Civil Aviation, the reform will benefit over 150 million annual flyers and promote growth in tier-2 and tier-3 city air travel, with emerging hubs including Prayagraj, Mysuru, and Jorhat set to see increased activity.

Why These Reforms Matter for Global Tourism

The aviation tax reforms in Sweden, Germany, and India reflect a wider international trend of revising tax policies to make air travel more affordable, equitable, and competitive. These countries recognize that punitive taxes can deter passengers and stifle recovery in sectors still reeling from pandemic-related disruptions.

For travelers, the benefits are tangible—cheaper tickets, more flight options, and renewed access to under-served routes. For airlines, the tax relief provides an opportunity to expand service networks, improve financial stability, and invest in sustainable innovations without compromising affordability.

International aviation associations such as IATA (International Air Transport Association) have welcomed these developments, urging more governments to adopt similar measures. According to IATA’s June 2025 economic report, “lowering air travel-related taxes could increase global passenger numbers by up to 8% year-on-year over the next two years.”

A Balancing Act: Affordability Meets Sustainability

While some environmental advocacy groups have raised concerns about reversing carbon-focused tax measures, governments argue that taxation alone is not the most effective tool for climate action in aviation. Instead, investment in sustainable aviation fuel (SAF), next-gen aircraft technology, and green airport infrastructure is being prioritized.

All three countries—Sweden, Germany, and India—are also investing in long-term sustainability solutions, including EU-funded clean energy grants, private-public partnerships for biofuel production, and domestic green aviation corridors.

Outlook: Toward a More Accessible Skies

The air travel tax rollbacks in Sweden, Germany, and India may signal a turning point for global aviation policy. As governments reevaluate the balance between environmental stewardship and economic growth, traveler-friendly reforms are gaining momentum. These changes not only enhance affordability but also empower airlines and travelers alike to re-engage with a revitalized global tourism landscape.

With more countries expected to follow suit, the era of high air travel taxes may be coming to an end—paving the way for a more inclusive, connected, and sustainable aviation future.

For more travel news like this, keep reading Global Travel Wire