U.S. Airlines Report $225 Million Q1 Loss as Travel Weakens and Global Uncertainty Looms Over 2025

In a stark reversal of recent aviation success stories, major U.S. airlines—including Delta Air Lines, Southwest Airlines, American Airlines, and Frontier—have collectively reported a first-quarter net loss of $225 million in 2025, according to the latest data from the Bureau of Transportation Statistics (BTS). After three straight quarters of profitability, this financial setback signals turbulence for the sector amid economic headwinds, waning consumer demand, and a steep drop in international visitors.

The loss, though narrower than Q1 2024’s $1.7 billion downturn, underscores growing concerns across the aviation and tourism landscape. As economic uncertainty tightens its grip, both leisure and business travelers appear to be pulling back—placing added stress on a sector still navigating post-pandemic recovery.

Domestic Demand Softens Amid Falling Disposable Incomes

The most immediate pressure is being felt in domestic travel. U.S. carriers reported negative pre-tax operating profits in their home markets, with bookings slowing due to reduced consumer spending power. Recent figures from the Federal Reserve Bank of St. Louis reveal that real disposable personal income in the U.S. has declined to $17,978 as of April 2025, down from $20,445 in March 2021.

With inflationary pressures, rising credit card debt, and an overall sense of caution among consumers, airfares are increasingly seen as expendable. A Bank of America analysis from May 2025 revealed weakened consumer spending on tourism, lodging, and air travel, confirming a broad behavioral shift.

Leading Carriers Withdraw Forecasts, Reflect Market Volatility

Several major carriers have responded to the downtrend with cautionary moves. American Airlines and Alaska Air Group reported losses of $473 million and $166 million respectively, and both withdrew their full-year earnings guidance. These decisions reflect heightened volatility and the likelihood that demand fluctuations may persist through the summer.

The message is clear: U.S. carriers are not just reacting to one weak quarter—they are recalibrating for a potentially prolonged slowdown.

International Tourism to the U.S. Sees Significant Decline

On the international front, the U.S. travel sector is facing an even steeper falloff. According to a May report by the World Travel & Tourism Council (WTTC), international visitor spending is projected to decline by $12.5 billion in 2025—a 22.5% year-on-year drop.

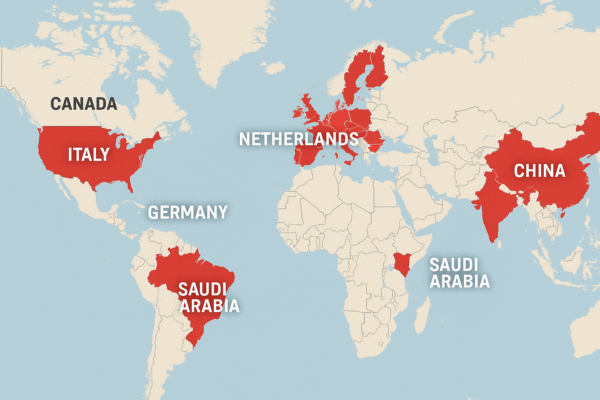

Tourism arrivals from key markets have already dipped dramatically. March 2025 data shows inbound travel from the United Kingdom fell 15%, Germany 28%, and South Korea 15%. These markets are traditionally among the top five international visitor sources for the U.S., and their absence is hitting major gateways like New York City, Orlando, San Francisco, and Las Vegas hard.

Without targeted recovery campaigns and improved visa facilitation efforts, tourism leaders warn it could take years to return to pre-pandemic levels.

Government and Corporate Travel Also Recedes

The weakening of government and corporate travel segments has compounded the problem. Airlines that rely heavily on these revenue streams—particularly for consistent year-round seat occupancy—are seeing meaningful declines in contract bookings.

A recent JP Morgan report suggests that government-related air travel, which serves as a financial anchor for several domestic carriers, has seen a decline, leading to additional downward pressure on revenues and stock prices.

Airline Stocks Enter Correction Phase

With carriers lowering earnings forecasts and delaying fleet expansions, aviation stocks have entered correction territory. Market analysts note that airline equities typically drop 30–40% during recessionary trends but often rebound strongly once macroeconomic indicators stabilize.

Still, as economic warning signs multiply—ranging from job market shifts to oil price volatility—the timeline for recovery remains uncertain.

Summer Travel Offers Temporary Lift

Despite the challenging Q1, analysts are cautiously optimistic about a potential rebound in Q2 thanks to summer travel surges. The American Automobile Association (AAA) projects that 5.84 million Americans will fly over the Fourth of July holiday—a 1.4% increase over 2024 and a record for the holiday.

This anticipated spike could offer short-term relief to carriers, especially on high-volume domestic routes. However, aviation experts warn that holiday peaks cannot compensate for year-long softening across broader segments.

Calls for Federal Leadership in Travel Recovery

Tourism industry stakeholders are urging the U.S. government to play a more proactive role in restoring confidence among global travelers. The WTTC and U.S. Travel Association are advocating for clearer visa policies, faster processing times, and marketing initiatives aimed at high-yield international visitors.

The sentiment is echoed across state tourism boards and airport authorities, who view inbound tourism as critical not just for airline health, but for job creation and local economic stability.

Outlook: A Cautious Ascent Ahead

As the U.S. aviation sector moves further into 2025, the industry finds itself at a pivotal crossroads. The $225 million Q1 loss is more than a financial setback—it is a reflection of deepening structural challenges that demand strategic reinvention.

Fuel costs, labor dynamics, international diplomacy, and consumer sentiment will all shape what comes next. For now, airlines are choosing caution—delaying expansions, trimming routes, and investing in efficiency over growth.

Yet the resilience of the industry should not be underestimated. If airlines, policymakers, and tourism partners align on recovery efforts, the sector could stabilize and regain altitude in the latter half of the year.

The path forward won’t be easy—but the skies aren’t closed. They’re just more unpredictable than before.

For more travel news like this, keep reading Global Travel Wire