The global airport information system (AIS) market is witnessing rapid expansion, propelled by leading aviation economies such as the United States, China, India, and Japan. With air travel demand rebounding strongly post-pandemic and global air traffic surging, these countries are investing in next-generation technologies to modernize airport operations and improve passenger experience.

According to industry projections, the global AIS market is expected to grow from $3.97 billion in 2024 to $4.2 billion in 2025, with a compound annual growth rate (CAGR) of 5.9%, and reaching approximately $5.2 billion by 2029. This upward trajectory reflects the accelerating need for digital integration, AI-based operations, and enhanced real-time systems to manage the complexities of modern air travel.

Real-Time Data, Automation, and IoT Shape Next-Gen Airport Operations

Airports today face mounting pressure to process high passenger volumes while maintaining efficiency and safety. The integration of real-time data, Internet of Things (IoT) systems, and automated workflows is revolutionizing how airports handle traffic surges, flight scheduling, baggage management, and security checks.

In India, Adani Airport Holdings unveiled its proprietary platform “Avio” in late 2024, providing real-time data on gate assignments, baggage tracking, and passenger flow. Meanwhile, Japan has been expanding smart terminal solutions at major hubs like Narita and Haneda, incorporating AI to forecast crowd density and optimize queuing systems.

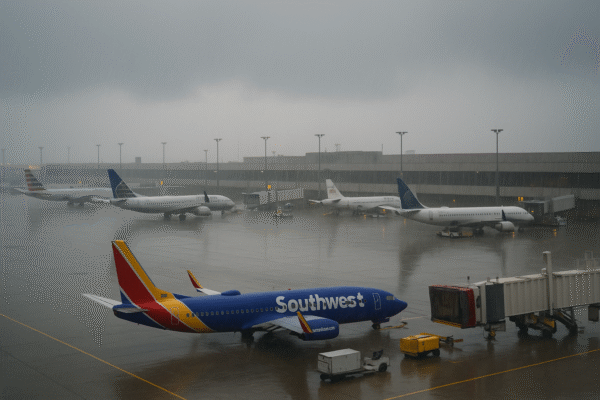

The United States, especially through large-scale hubs like Newark Liberty International Airport, continues to push digital aviation initiatives despite challenges such as air traffic controller shortages. The Federal Aviation Administration (FAA) is currently prioritizing investment in tech modernization and controller recruitment, aligning with broader federal goals to enhance aviation infrastructure.

In China, massive expansion of regional airports and smart terminal deployments are further fueling demand for integrated airport information systems, in alignment with Beijing’s five-year plan for digital transformation across transportation networks.

Passenger-Centric Innovation at the Core of Market Demand

The International Air Transport Association (IATA) reported a 36.9% year-on-year increase in global air traffic in 2023, reflecting booming travel demand. This has translated into a pressing need for passenger-centric technologies, including self-service check-in kiosks, mobile app notifications, and AI-powered customer service bots.

Airport information systems today are no longer limited to backend operations. They are becoming a vital interface between airports and travelers—facilitating seamless navigation, reducing wait times, and ensuring timely updates during disruptions. Smart signage, predictive queue monitoring, and facial recognition-based boarding are just a few examples transforming the airport journey.

Key Market Segmentation Highlights

The AIS market is segmented based on technology type, airport function, application, and end-user:

- Type: Airside systems (air traffic control, ground handling) and terminal-side systems (passenger info displays, baggage handling).

- Function: Departure control, operations centers, flight information management.

- Application: Passenger systems (check-in, wayfinding), non-passenger systems (baggage, security, cargo).

- Airport Category: Class A (major hubs) to Class D (regional airports), with Class A airports demanding the most sophisticated systems.

As travel resumes, Class A airports like Chicago O’Hare, Tokyo Haneda, New Delhi IGI, and Beijing Capital International Airport are investing heavily in these technologies to maintain global competitiveness.

Leading Companies Fueling AIS Innovation

Several global players dominate the AIS space with robust R&D pipelines and turnkey airport solutions:

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- NEC Corporation

- Siemens AG

- Thales Group

- RTX Corporation

- Lockheed Martin Corporation

- SITA

- Lufthansa Systems

These companies offer a range of software and hardware products that optimize gate utilization, streamline communication between ground crews and aircraft, and integrate predictive analytics into day-to-day airport management.

Regional Dynamics: North America Leads, Asia-Pacific Accelerates

North America, led by the United States, remains a powerhouse in AIS technology adoption. With dozens of high-capacity airports and strong government backing, U.S. airports are often the first to deploy emerging aviation technologies.

However, Asia-Pacific is poised to see the fastest AIS market growth. Rapid airport construction across China, India, Indonesia, Vietnam, and the Philippines, paired with rising middle-class travel demand, makes the region fertile ground for smart aviation systems. Government policies such as India’s UDAN scheme and China’s Belt and Road aviation projects further accelerate this expansion.

Outlook: AIS Will Define the Future of Seamless Air Travel

As the aviation sector evolves, airport information systems will play an even more central role in delivering efficient, secure, and personalized travel experiences. With AI, IoT, 5G, and cloud computing driving innovation, airports are transitioning into digital ecosystems that rely on real-time coordination and predictive technologies.

The continued growth of the AIS market through 2029 reflects the global consensus: future-ready airports must be data-driven, passenger-focused, and fully integrated. For travelers, this means fewer delays, smoother journeys, and more responsive services.

For aviation stakeholders—from government planners and airport operators to tech companies—the path forward is clear: invest in airport information systems or risk falling behind in the global race toward smarter air travel.

For more travel news like this, keep reading Global Travel Wire