Washington, D.C. & Mexico City – The U.S. Department of Transportation (DOT) has enacted a series of stringent new measures targeting Mexican airlines operating in the United States. Among the most consequential changes is the withdrawal of antitrust immunity for the Delta–Aeromexico joint venture, fueling speculation that several U.S.–Mexico routes may face major disruptions. Amid these developments, tensions between the two countries’ aviation sectors are escalating swiftly.

Regulatory Clampdown Amid Slot Dispute

In July, the DOT imposed sweeping new restrictions on Mexican carriers, including a requirement to file all U.S.-bound routes and obtaining prior approval for large passenger and cargo charter flights. These actions stem from growing frustration over Mexico’s unilateral decision to rescind flight slots held by U.S. airlines at Mexico City’s Benito Juarez International Airport (MEX), and shift operations to its more distant counterpart, Felipe Angeles International Airport (AIFA). The DOT claims these moves violate the bilateral open skies agreement and place U.S. carriers at a distinct disadvantage.

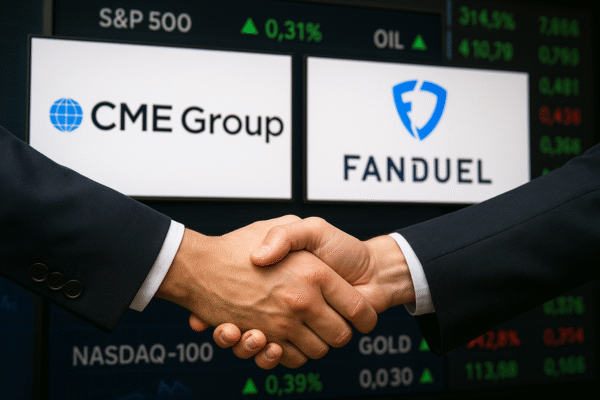

Antitrust Immunity Revoked: Delta–Aeromexico Joint Venture in Jeopardy

In a move backed by the U.S. Department of Justice, the DOT has signaled its intent to revoke antitrust immunity granted to the Delta–Aeromexico joint venture—a partnership that has enabled shared scheduling, pricing, and capacity coordination since 2016. The immunity allows joint operation of routes; without it, up to two dozen flights may be canceled or restructured.

Both airlines warn that dismantling the venture could threaten approximately 4,000 U.S. jobs, jeopardize 800 million USD in economic benefits, and destabilize tourism flows across the border. Meanwhile, the DOT and DOJ argue that competitive fairness—over favorable alliances—must prevail.

Broadening Airlines’ Involvement

As Delta and Aeromexico navigate these challenges, Allegiant Air and Viva Aerobus have seized the moment to advance their own long-standing request for a joint business venture. They argue the alliance would offer affordable services on overlooked routes and swiftly benefit underserved travelers.

Meanwhile, American Airlines has publicly supported the DOT’s intervention, citing Mexico’s retaliatory policies and transparency concerns at MEX airport as troubling precedents.

Passenger Impact & Tourism Ramifications

** Passengers might face route cancellations, reduced frequencies, and rising fares**, as airline partnerships unravel and flight patterns change. Popular gateways like Mexico City, Cancun, and Los Cabos may see fluctuations in seat availability and service options. Business travelers and tourists alike should monitor bookings closely—adjusting plans or seeking alternatives in light of potential service gaps.

Such disruptions could alter cross-border travel dynamics significantly, threatening recovery momentum in tourism-dependent cities on both sides.

Broader Aviation Impacts & Political Undertones

This aviation dispute symbolizes deeper tensions in U.S.–Mexico relations, with aviation policy used as leverage ahead of the upcoming USMCA (United States–Mexico–Canada Agreement) review. Analysts suggest the DOT’s assertive stance is part of a longer-term strategy to re-establish aeropolitical balance.

What Lies Ahead for Stakeholders

| Stakeholder | Outlook |

|---|---|

| Delta & Aeromexico | Must justify continued joint venture or unwind operations by October 25, 2025. |

| Passengers | Should consider flexible travel arrangements and monitor airline updates. |

| Competing Carriers | Allegiant/Viva may gain approval for low-cost options if DOT greenlights their joint venture. |

| Regulators | DOT signals broader enforcement of fair competition; monitoring slot allocation practices. |

Conclusion

The DOT’s recent restrictions against Mexican carriers, coupled with the revocation of Delta–Aeromexico’s antitrust immunity, reflect heightened U.S. vigilance over bilateral aviation fairness. As airlines and passengers recalibrate, the wider implications for tourism, aviation strategy, and international policy are unfolding. This development underscores the strategic nexus where diplomacy, economics, and air travel converge.

For more travel news like this, keep reading Global Travel Wire