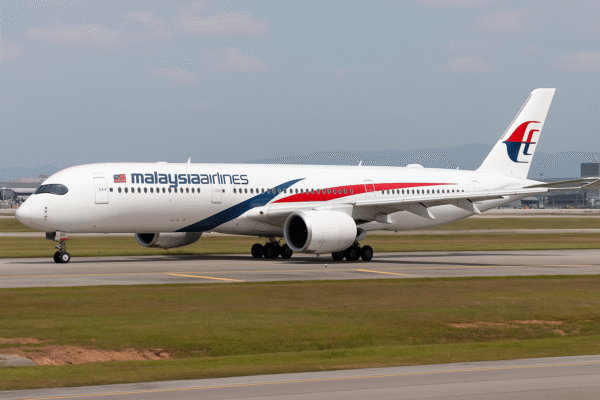

Carnival Cruise Lines remains one of the most closely followed names in the United States tourism industry. Its scale and global reach make it a key indicator of cruise sector health. The company recently reported strong third-quarter earnings, surpassing forecasts and reinforcing optimism about the return of international travel. Investors initially welcomed the news with enthusiasm.

Share prices climbed in early trading after the earnings release. Confidence grew as Carnival once again raised its annual financial outlook. This marked the third consecutive quarter of upgraded guidance, sending a signal of consistent operational recovery. For many, the strong numbers represented proof that cruise travel had bounced back from its most difficult years.

Yet, as the trading day progressed, optimism turned to caution. Investors began to focus less on revenue and more on debt. Concerns about Carnival’s refinancing plans sparked a sharp reversal. By market close, earlier gains had vanished, and shares ended the session in negative territory.

A Day of Market Drama

The trading session highlighted the volatility that often surrounds high-profile travel stocks. Carnival shares surged more than 6% in early trading. By midday, however, sellers outnumbered buyers. The stock dropped steadily, closing 4% lower at $29.40.

This sudden swing reflected the market’s unease with debt-related announcements. Carnival revealed plans to redeem $1.31 billion in outstanding convertible notes using both cash and equity. While the move was designed to reduce debt, the mention of equity raised alarms. Investors feared dilution of their ownership stakes, a risk that often weighs heavily on share value.

Earnings Beat Analyst Expectations

Carnival’s earnings report contained numbers that impressed analysts and investors alike. Third-quarter revenue reached $8.12 billion, up 3.3% year-over-year. Adjusted earnings per share rose to $1.43, a jump of 12.3%. These results exceeded Wall Street expectations, confirming strong passenger demand and effective cost management.

Net yields, a key measure of revenue per available passenger capacity, surpassed forecasts. Costs per berth day also declined, indicating efficiency improvements across operations. Adjusted EBITDA came in ahead of estimates, adding to the positive picture.

The strength of these results prompted management to revise full-year guidance higher once again. For the third straight quarter, Carnival showed investors that growth was both real and sustainable.

Debt Burden Remains the Main Concern

Despite the strong earnings story, Carnival’s debt profile continues to overshadow its progress. The company built up heavy obligations during the cruise suspension period. Today, net debt remains around $25.4 billion.

Management confirmed that the company intends to redeem its convertible notes using cash and equity. While this step reduces immediate debt, it also increases the risk of ownership dilution. Shareholders worry about the long-term effects on value, particularly after months of share price recovery.

Valuation and Leverage Position

Carnival’s market capitalization stands at roughly $40 billion. Adding net debt, the enterprise value totals around $64.8 billion. With projected 2025 EBITDA of $7.1 billion, the company trades at an EV/EBITDA ratio near 9.1.

This valuation is not extreme but leaves little room for error given the debt load. Management aims to reduce the debt-to-EBITDA ratio from 3.57 to below 3. Achieving this goal would improve credit ratings and help the company refinance at lower interest rates. Until then, leverage concerns will likely keep investors cautious.

Broader Implications for U.S. Tourism

Carnival’s performance matters beyond shareholders. As one of the largest cruise operators, its results ripple through the entire United States tourism industry. Cruise lines were among the hardest hit during global shutdowns, suffering losses from suspended operations and stranded vessels.

The rebound in demand highlights the resilience of consumer travel behavior. Bookings continue to rise, and travelers remain eager for cruise holidays. However, the financial scars of the shutdown linger. Heavy debt burdens remain across the industry, forcing operators to balance expansion with financial discipline.

Carnival’s challenge reflects a broader reality. Tourism in the United States thrives on strong demand, but sustainability requires sound financial management. Investors will not overlook debt risks, no matter how strong the booking numbers appear.

Opportunities and Risks for Investors

For investors, Carnival presents a mixed picture. The operational recovery story is strong. Revenues grow, costs fall, and passenger demand remains robust. These elements make the stock attractive for long-term growth.

On the other hand, risks cannot be ignored. Debt levels remain high, and the possibility of dilution complicates shareholder value. Investors weighing opportunities in Carnival must balance optimism with caution.

The key question centers on execution. Can Carnival reduce leverage quickly enough to unlock further growth potential? The answer will likely define the stock’s trajectory over the next several years.

Bottom Line

Carnival Cruise Lines demonstrates both the promise and the challenge of the tourism recovery story in the United States. Strong earnings prove the resilience of cruising and the appetite for travel. Yet debt concerns continue to limit confidence, creating volatility in the stock market.

Investors celebrated Carnival’s revenue growth and operational strength but worried about equity issuance and ownership dilution. The day’s trading swings reflected this tension between optimism and caution.

Carnival remains a symbol of the cruise industry’s resilience. It showcases how far the sector has come since shutdowns but also reminds stakeholders of the financial hurdles ahead. For investors, the journey remains tied to debt management and market confidence.

For more travel news like this, keep reading Global Travel Wire