Summer 2025 is ushering in a noticeable transformation in German travel preferences, with popular holiday mainstays like Turkey witnessing a downturn while destinations such as Greece, Bulgaria, and Egypt rise in prominence. According to the latest figures from Travel Data + Analytics (TDA), the dynamics of outbound tourism from Germany are changing significantly due to economic concerns, climatic shifts, and evolving consumer priorities.

Turkey’s Tourism Appeal Slips Amid Economic Pressures

Once a dominant force in the German tourism market, Turkey is now grappling with a 10% drop in bookings compared to summer 2024. Even the ever-popular Turkish Riviera has not been spared, seeing a 12% decline despite widespread last-minute discounts offered by local hoteliers. Inflation and elevated hotel pricing are cited as key reasons discouraging German tourists, many of whom are actively seeking more affordable yet high-quality alternatives.

With the euro weakened and Turkish lira volatility persisting, many travelers perceive reduced value for money in Turkey, pushing them toward less expensive destinations with comparable offerings.

Greece Emerges as a Top Alternative

In contrast, Greece is experiencing a surge in demand. Building on its impressive 2024 performance, when it attracted over 5.4 million German visitors, the country appears poised for another record-breaking summer. Early 2025 booking data suggests strong growth across both the Greek islands and mainland destinations.

Greece’s success can be attributed to its winning formula of stable weather, rich cultural experiences, scenic coastal offerings, and relatively competitive pricing. Unlike Turkey and even Spain, which is also showing signs of a downturn, Greece is one of the few Mediterranean countries capturing increasing market share among German travelers. Tour operators are seeing longer booking lead times, with customers locking in rates earlier to secure deals and family discounts.

Spain Retains Lead but Loses Momentum

Spain continues to be the most visited destination among German tour operator customers, accounting for approximately 30% of all summer bookings. However, it has registered a 4% year-on-year decline, with rising prices on the Balearic and Canary Islands beginning to deter cost-conscious tourists.

While the Canary Islands remain attractive during the winter season, the cost per night during peak summer months has escalated. A stay in Majorca, for instance, averages €141 per person per night, compared to approximately €110 per night in emerging destinations like Bulgaria and Egypt.

Budget-Friendly Destinations Gain Ground

Among the biggest winners of the summer 2025 shift are budget-conscious locales. Bulgaria’s Black Sea coast has seen a remarkable 25% year-on-year surge in German bookings. Similarly, Cyprus (15% growth), Egypt (12%), Poland (9%), and France (8%) have also witnessed notable gains.

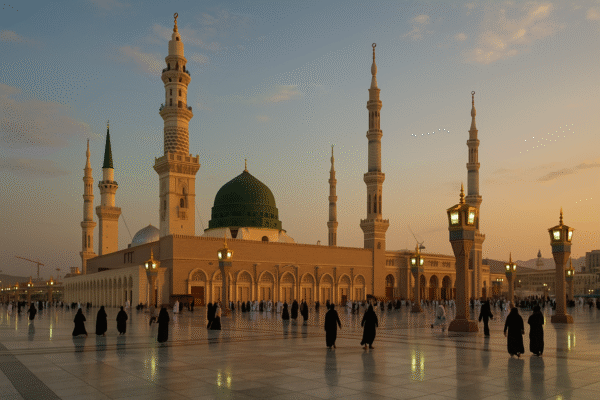

Egypt’s Red Sea resorts like Marsa Alam and Hurghada are being re-evaluated by German families as prime holiday spots that offer warm weather, comprehensive all-inclusive packages, and excellent diving opportunities—at a fraction of the cost found in western Mediterranean resorts.

Tunisia is another destination benefiting from price-sensitive travelers. The island of Djerba, in particular, is attracting attention for its competitive rates and exotic appeal.

Travelers Turn to Shoulder Season Escapes

The traditional July-August holiday peak is being gradually reshaped by changing booking habits. German tourists are increasingly traveling during the shoulder seasons—particularly October—which has seen a 25% rise in holiday bookings between 2019 and 2024.

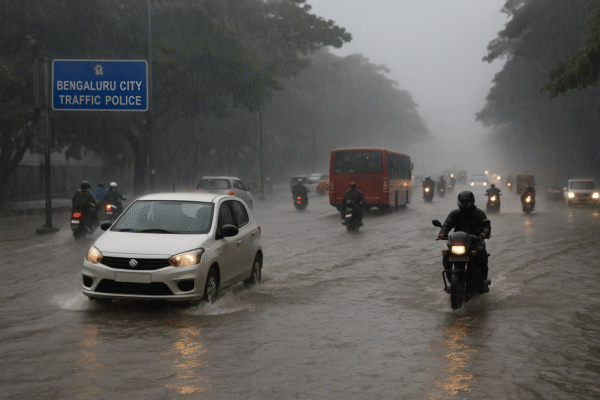

This trend is not just driven by pricing but by climatic concerns. With extreme summer temperatures and wildfire threats across Southern Europe becoming more frequent, spring and autumn are emerging as the preferred times to travel.

Booking Behavior: Early, Shorter, Smarter

Another key transformation is in booking behavior. Average booking lead times in 2024 were already 109 days in advance—a 9% increase over the previous year. This trend is expected to continue into 2025, especially among families keen on securing child discounts and flight deals.

Moreover, vacation duration is gradually shortening. The average organized holiday has declined from 9.5 to 9.0 days over the past five years. This shift is a result of increasing workplace flexibility, rising costs, and a new preference for more frequent short getaways rather than one long trip.

Can Turkey Rebound?

Turkey’s tourism industry, heavily reliant on German and Russian travelers, now faces the challenge of reversing the downward trend. While some resilience is visible in the Aegean region, major destinations along the Mediterranean coast may need to reevaluate their pricing strategies to stay competitive.

Efforts to boost demand through discounts and package deals are underway, but unless inflationary pressures stabilize, a full recovery could be difficult. Diversifying offerings, investing in mid-market hospitality, and targeting off-peak travelers may be necessary to recapture the confidence of German holidaymakers.

Conclusion

As Summer 2025 approaches, German tourists are clearly shifting gears—prioritizing affordability, flexibility, and more temperate destinations. Countries like Greece, Bulgaria, and Egypt are stepping up to meet this demand with competitive pricing and attractive offerings. If these booking trends continue, they could signal a lasting realignment of Germany’s outbound tourism map for years to come.

For more travel news like this, keep reading Global Travel Wire