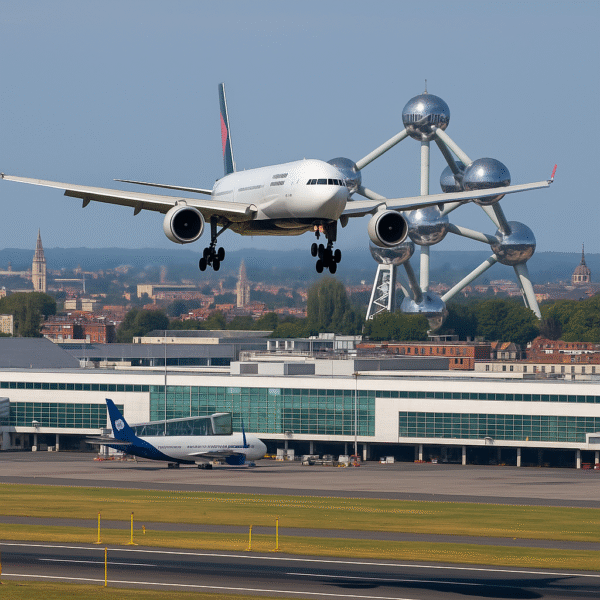

Greece has soared to the top of Mediterranean travel charts in August 2025, achieving a new milestone in air travel with over 5.3 million airline seats scheduled. According to data released by INSETE, the research branch of the Greek Tourism Confederation (SETE), this figure marks a 4.7% year-on-year increase—a testament to Greece’s growing influence as a Mediterranean tourism powerhouse.

This record-breaking momentum is driven by both traditional European markets like the UK, Germany, and Italy, as well as strong growth from Israel, the United States, and Turkiye. Greece’s strategic efforts to expand airline connectivity, promote high-season offerings, and modernize its airport infrastructure have collectively paid off, setting the tone for a robust close to the 2025 summer travel season.

✈️ Air Travel by the Numbers

According to the latest Air Data Tracker insights, seat availability for August 2025 is forecast to hit 5,380,128, up from 5,153,893 in August 2024. This surge reaffirms Greece’s resilience and appeal, especially compared to other Mediterranean destinations like Spain, Portugal, and Italy, which reported either smaller gains or slight declines in air travel volume.

📈 Top Growth Markets: Israel, Türkiye & the U.S.

Israel takes center stage as the fastest-growing inbound market, with a 33% increase in airline seat capacity, rising from 186,279 seats in August 2024 to 247,692 this year. This leap is largely attributed to enhanced travel ties, direct flight routes, and a rising trend in religious and cultural tourism between the two nations.

Türkiye follows with a 31.2% year-on-year increase, offering 97,361 seats. Meanwhile, the U.S. market recorded a 24.6% growth, totaling 129,193 seats—a reflection of Greece’s successful efforts to attract long-haul American travelers through targeted marketing and airline partnerships.

🇬🇧 🇩🇪 🇮🇹 Europe’s Power Trio Still Dominates

While new growth markets are surging, the UK, Germany, and Italy remain Greece’s backbone for inbound tourism.

- United Kingdom: With 1,025,875 scheduled seats, the UK holds its top source market status, increasing 3.8% year-on-year. British tourists continue to favor Greek islands and coastal cities for their summer escapes.

- Germany: Offers approximately 817,000 seats, up by 1.9%, reaffirming its long-standing position as the second-largest contributor.

- Italy: Adds 628,175 seats, reflecting a 4.2% year-on-year increase, driven by stronger regional connectivity and cultural affinity between the two Mediterranean nations.

📉 Mixed Signals from France, Poland & Czech Republic

Despite the broader upward trend, not all European markets kept pace:

- France dropped by 8.3%, down to 336,983 seats.

- Czech Republic saw an 8.5% decline, totaling 134,626.

- Poland posted an 8.4% reduction, matching U.S. seat figures at 129,193.

These dips may point to rising competition from other destinations, economic headwinds, or shifting traveler behaviors within Central and Eastern Europe.

🛫 Airport Winners: Athens, Thessaloniki & Aktion

Athens International Airport (LGAV) continues to lead as Greece’s primary aviation hub, hosting 1,622,091 seats this August—a 7.8% increase year-over-year. The capital remains the main gateway for long-haul and European visitors alike.

Thessaloniki Airport (SKG) posted one of the country’s strongest gains, with a 12.4% jump in capacity. Meanwhile, Aktion Airport on the western mainland recorded an 11.9% surge, positioning it as a rising star for regional and charter traffic.

🏝️ Greek Islands: Steady but Selective Growth

The island airports reflected a mixed performance:

- Crete (Heraklion) rose 3%, while Chania climbed 5.3%.

- Rhodes grew 3%, and Corfu 3.5%.

- Mykonos stayed nearly flat at 0.2% growth, signaling stable demand amid overtourism concerns.

- Zakynthos fell by 0.6%, and Santorini dropped 7.3%.

- Kos and Kefalonia declined 1% and 3.9%, respectively, suggesting either saturation or infrastructure limitations.

These trends suggest travelers are diversifying beyond the typical hotspots, exploring lesser-known islands and the Greek mainland.

🌍 Greece Outpaces Mediterranean Rivals

As of June 2025, Greece recorded a 5.7% increase in total airline seat capacity compared to the same period last year—outpacing Spain’s 2.8% and far exceeding Italy and Portugal, which both reported marginal declines.

This growth is bolstered by:

- Strategic coordination with airlines

- Increased marketing efforts across international media

- Airport modernization and tourism investment

🇬🇷 Greece’s Competitive Edge in 2025

The Greek tourism industry is not only recovering post-pandemic but thriving through smart policies, infrastructure upgrades, and global partnerships. By focusing on connectivity and diversification, Greece continues to attract a broad range of travelers—families, solo adventurers, cultural tourists, and luxury seekers alike.

As August 2025 shapes up to be one of the most successful months in recent history, Greece confirms its position as the undisputed leader in Mediterranean air travel.

For more travel news like this, keep reading Global Travel Wire