Thailand’s Tourism Outlook Hit by Iran–Israel Conflict: Sharp Declines in Israeli and Iranian Arrivals Forecast

Bangkok, June 2025 — Thailand’s booming tourism sector is facing a significant setback as escalating hostilities between Iran and Israel threaten to severely disrupt inbound travel from both countries. The Tourism Authority of Thailand (TAT) has issued a cautious forecast, warning that the recent intensification of the Iran–Israel conflict—marked by direct military engagement on June 13, 2025—is likely to diminish tourist arrivals from the Middle East, a region that has been contributing steadily to Thailand’s international travel market.

Both Bangkok and Phuket, popular destinations for Israeli and Iranian tourists, are expected to experience a sharp dip in visitor numbers during the third quarter of 2025. This downturn comes at a time when Thailand is striving to maintain post-pandemic tourism momentum, following a strong start to the year.

Steep Projected Decline in Israeli Tourists

According to TAT’s preliminary projections, Israeli tourist arrivals to Thailand may fall by as much as 29% between June and September 2025. The worsening conflict, which includes Israeli military mobilization and cross-border strikes, is generating travel hesitancy and logistical hurdles for outbound travel from Israel.

To address the uncertainty, TAT has modeled two key scenarios:

Scenario 1: Stabilization Within Q3

Should the conflict de-escalate within the third quarter, Israel’s total tourist arrivals in Thailand for 2025 could still record a 24% year-on-year increase, reaching approximately 350,000 visitors. While promising, this would still represent a shortfall of 77,000 travelers compared to pre-conflict projections of 427,000, which initially estimated a 52% growth rate.

Scenario 2: Prolonged Hostilities Through November

If the conflict drags into late 2025, with military operations and travel disruptions continuing until November, recovery in Israeli tourism would be postponed until December. In this scenario, the annual total may dip to 335,000—92,000 below original expectations.

Despite these disruptions, TAT remains cautiously optimistic. The first five months of 2025 saw Israeli arrivals surge by 76% compared to the same period in 2024, providing a buffer against the anticipated downturn in Q3.

Iranian Tourism Takes a Severe Hit

In contrast, Iran’s outbound tourism to Thailand is facing a more immediate and dramatic collapse. From January to May 2025, only 28,259 Iranian travelers visited Thailand—a modest 2% drop year-over-year. However, the situation is expected to deteriorate significantly due to the closure of Iranian airspace and the suspension of direct flights by Mahan Air, Iran’s primary carrier operating to Thailand.

Mahan Air’s six weekly flights to Bangkok and Phuket—amounting to around 1,800 seats per week—will be grounded by the end of June. Without alternative carriers stepping in, the travel pipeline between Iran and Thailand is effectively shut off.

TAT officials caution that this disruption could mirror the steep 60% drop in Iranian arrivals recorded in 2018, following stringent U.S. sanctions. If similar patterns repeat, the Iranian tourism market may shrink dramatically in the second half of 2025.

Global Ripples and Regional Concerns

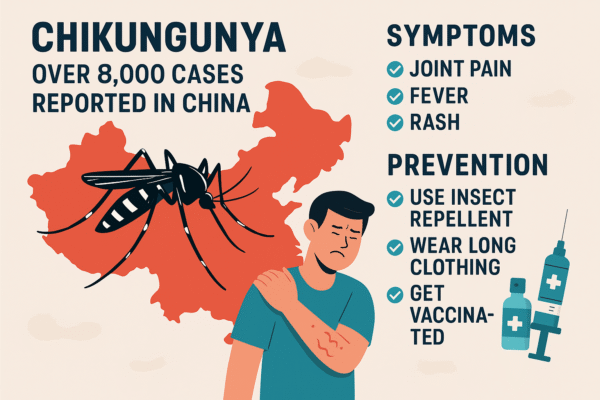

The ongoing Iran–Israel confrontation poses wider implications for global air travel and tourism. The closure of airspace, coupled with heightened security risks, may lead to rerouted flights, increased insurance costs, and a surge in cancellations, not just for direct routes but for long-haul travel connecting via the Middle East.

For Thailand, whose tourism sector contributes over 20% to GDP, the ripple effects could be felt across hospitality, retail, and local services, especially in popular destinations like Bangkok, Pattaya, and Phuket.

Furthermore, the psychological impact of the conflict on traveler sentiment cannot be underestimated. As geopolitical tensions rise, travelers from other nations may also reconsider visiting regions perceived as being near or affected by conflict, regardless of Thailand’s geographic distance.

A Call for Diversification and Strategic Recovery

In response, TAT is exploring targeted marketing campaigns in alternative source markets including India, China, Russia, and ASEAN neighbors. Strengthening ties with these regions, improving visa policies, and enhancing air connectivity are among the measures being evaluated to offset losses from Middle Eastern travelers.

The Thai government is also engaging with tourism stakeholders to ensure contingency planning, including hotel pricing flexibility, cancellation protections, and rebooking assistance. Travel agents and tour operators are being encouraged to diversify packages and reduce dependency on volatile markets.

Conclusion

As the Iran–Israel conflict unfolds, Thailand’s tourism sector finds itself navigating a complex web of uncertainty. While early-year gains in Israeli tourism provide some hope, the sharp downturn in Iranian arrivals and the broader risk of regional spillovers underscore the fragility of tourism in times of geopolitical unrest.

Moving forward, resilience and adaptability will be key. Thailand’s ability to pivot toward emerging markets, manage travel disruptions, and assure international visitors of safety will determine the trajectory of its tourism recovery in the face of global instability.

For more travel news like this, keep reading Global Travel Wire