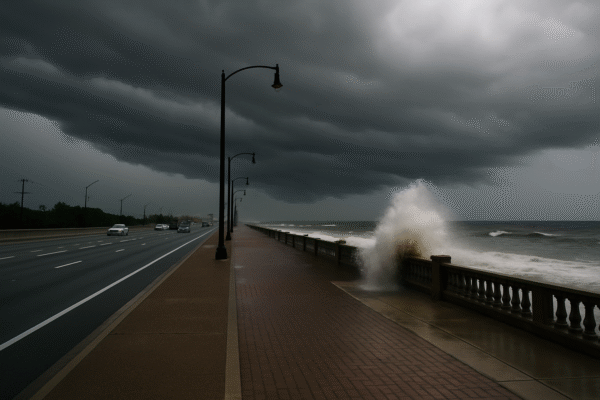

U.S. Tourism to Lose $12.5 Billion in 2025 as Foreign Visitors Rethink Travel Plans

WASHINGTON, D.C. – June 18, 2025 – What was forecasted to be a rebound year for American tourism has turned into a season of uncertainty, with the United States now expected to lose $12.5 billion in international travel spending in 2025. Analysts cite a combination of political tensions, controversial policies, and global perception shifts as primary drivers behind a steep 9.4% projected decline in foreign tourist arrivals.

According to research firm Tourism Economics, international visitation to the U.S. is falling below expectations, with Canada leading the retreat. Canadian arrivals by car in April dropped 35.2% year-on-year, while air arrivals fell by nearly 20%, as Canadian travelers respond to trade disputes, immigration crackdowns, and rising geopolitical unease.

Once forecast to grow by 9%, international arrivals are now forecast to fall by the same margin, dealing a serious blow to airlines, hotel chains, and travel operators that had anticipated post-pandemic recovery to surge in 2025.

International Sentiment Cools Toward U.S. Travel

The erosion of global goodwill toward the U.S. is a major factor. Foreign visitors, particularly from Europe and Canada, have expressed growing discomfort with the U.S.’s political climate. Travel analysts point to the Trump administration’s “America First” agenda, which has inflamed trade tensions, implemented stricter border controls, and fostered an unwelcoming image for inbound travelers.

Adam Sacks, president of Tourism Economics, says the current climate is uniquely discouraging for global leisure travel:

“Leisure tourism is the most sensitive to perception. We are beginning to see the full impact of economic uncertainty and unwelcoming policies.”

For example, Monique Dubas, an engineer from Paris, canceled a planned June trip to New York in protest after a fellow French citizen was denied entry at the U.S. border. Her decision mirrors a growing trend among international travelers who are now turning to alternative destinations such as Mexico, Spain, and Southeast Asia, all perceived as friendlier and less politically turbulent.

Travel Industry Takes a Hit

Leading U.S.-based hospitality and tourism companies are now adjusting their projections. Hotel giants Marriott, Hyatt, and Hilton have reported softer-than-expected demand and have lowered their revenue outlooks for the second and third quarters. Expedia and Airbnb have similarly revised their expectations downward, citing booking slowdowns from Europe and Canada.

Data from the U.S. Department of Commerce shows that while arrivals from countries like Germany and the UK showed slight recovery in April, visitor numbers from France remained down 12.2% compared to the same period in 2024.

Even as the Easter holiday may have skewed March figures, April’s rebound wasn’t strong enough to offset broader losses. Most concerning is that Canada, traditionally the United States’ largest tourist market, continues to see multi-month declines in visits, especially overland travel.

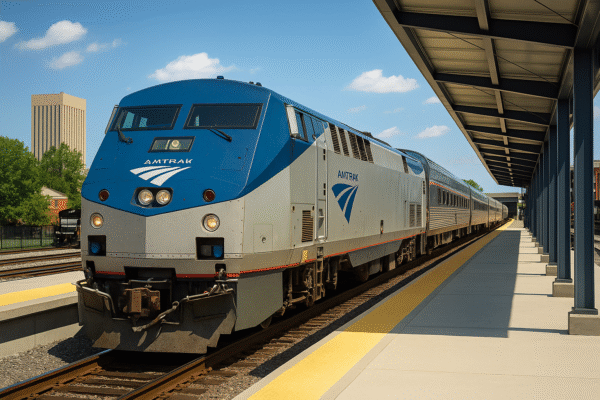

Domestic Travel Rises Amid International Shortfall

Domestically, some of the tourism shortfall is being offset by increased travel from within the United States. According to Bank of America’s Summer Travel and Entertainment Outlook, 70% of Americans plan to travel domestically this summer, driven by affordability and recession fears.

Airfare prices have also declined across the board—5.3% lower year-over-year in March—with average domestic summer tickets down by 7%, according to data from the Airlines Reporting Corporation (ARC).

Despite this domestic boost, it does not fully compensate for international losses. Foreign travelers typically stay longer and spend more, especially in premium accommodations and attractions, making their absence significantly more impactful on local economies.

Tourism Leaders Call for National Strategy

Geoff Freeman, CEO of the U.S. Travel Association, emphasized the need for a coordinated, nationwide effort to repair America’s brand image. He warned that without intervention, these negative perceptions could become entrenched, jeopardizing long-term visitor growth.

“We’re approaching pivotal events like the 250th anniversary of American independence in 2026, the FIFA World Cup, and the 2028 Summer Olympics,” Freeman said. “If we don’t act now to reintroduce America as a welcoming and safe destination, we risk underperforming during the biggest tourism opportunities of the decade.”

The National Travel and Tourism Office declined to comment on the projections. Meanwhile, Brand USA, a partially government-funded marketing agency, is preparing to launch a global promotional campaign aimed at reversing the trend. The effort will showcase everything from rural destinations to major cities, aiming to counter the political narrative with cultural richness and hospitality.

States and Cities Adjust Expectations

Popular destinations are recalibrating. Visit California recently downgraded its annual forecast by 1%, now anticipating 268 million visitors this year. New York City Tourism and Conventions, originally projecting 67.6 million visitors, has revised its number to 64.1 million, noting particular weakness in international demand.

Both organizations have launched international marketing efforts. California’s “California Loves Canada” campaign—offering 25% discounts to Canadian travelers—and New York’s “With Love + Liberty” initiative are examples of region-specific responses to the broader national decline.

Jessica Walker, CEO of the Manhattan Chamber of Commerce, notes that while domestic tourism has buoyed local businesses, the lack of international visitors remains a pressing concern. “They spend more, stay longer, and sustain entire sectors like museums and luxury retail,” she said.

A Cautious Outlook Ahead

Despite setbacks, luxury travel remains resilient. According to Virtuoso, summer demand for upscale U.S. experiences is up 23%. The appeal of national parks, wine regions, and exclusive resorts continues to draw high-net-worth travelers from both domestic and international markets.

Still, the long-term health of the tourism industry depends on strategic communication and policy reform. As Sacks noted, “The U.S. is still a top global destination. But that won’t last if we continue to send mixed messages.”

Without a unifying national message of welcome and clarity on entry policies, the U.S. may continue to watch billions in tourism revenue drift to friendlier shores.

For more travel news like this, keep reading Global Travel Wire