Planning a trip is exciting—booking flights, creating itineraries, and imagining the experiences ahead. But one crucial step that many travelers overlook is travel insurance. Whether you’re going on a short city break or a long international journey, insurance offers peace of mind and financial protection against the unexpected. From delayed flights to medical emergencies abroad, having the right coverage can turn a travel disaster into a manageable hiccup.

Why Travel Insurance is Essential

Travel is unpredictable. Even the best-planned trips can face unexpected problems, and dealing with them abroad can be costly and stressful. Here are the main reasons why travel insurance should be on your checklist:

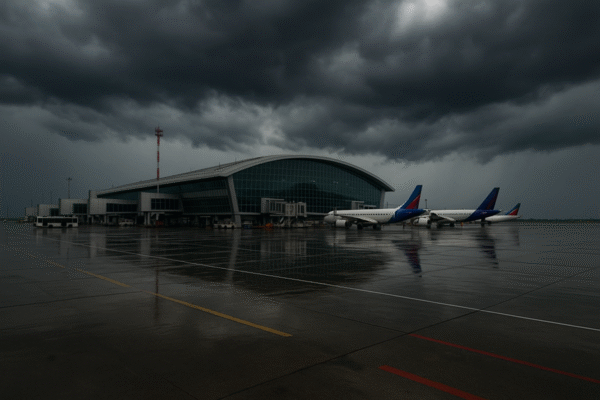

- Flight Cancellations & Delays

Airlines may cancel or delay flights due to weather, strikes, or mechanical issues. Without insurance, you could end up paying extra for last-minute rebookings or hotels. A good travel insurance policy can reimburse you for these unexpected costs. - Lost or Delayed Luggage

Imagine arriving at your dream destination without your suitcase. Luggage issues are common, and replacing essentials can quickly add up. Insurance helps cover these expenses, ensuring your trip continues smoothly. - Medical Emergencies Abroad

Healthcare costs outside your home country can be shockingly high. A sudden illness or accident may lead to thousands in hospital bills. With travel medical coverage, you can get the treatment you need without worrying about the financial burden.

Types of Travel Insurance Options

Not all policies are the same. Depending on your trip, you can choose from different coverage levels:

- Single-Trip Insurance – Perfect for one-time vacations or business trips. Covers you for the duration of that journey.

- Multi-Trip (Annual) Insurance – If you travel often, this option saves money and hassle. It provides coverage for multiple trips within a year.

- Medical-Only Insurance – Designed for those mainly concerned about healthcare abroad. Ideal if your primary worry is hospital and doctor costs.

- Comprehensive Insurance – A full package that includes medical, luggage, cancellations, and more. Best for long-haul or international travel.

Tips for Choosing the Right Travel Insurance

When comparing travel insurance options, keep these points in mind:

- Destination Matters – Some countries have higher healthcare costs than others, so check coverage limits carefully.

- Check Exclusions – Adventure sports, pre-existing conditions, or certain destinations may not be covered.

- Compare Providers – Don’t just go for the cheapest plan. Look at customer reviews, claim processes, and coverage details.

- Emergency Support – Choose providers offering 24/7 support so help is always available.

Real-Life Scenarios

- Scenario 1: A traveler heading to Europe faces a canceled flight due to snowstorms. Their travel insurance covers hotel stays and rebooking costs.

- Scenario 2: On a beach vacation, a tourist injures their leg while snorkeling. Medical bills reach thousands, but insurance covers the emergency care.

- Scenario 3: A business traveler loses a suitcase with important documents and clothing. Insurance reimburses them, minimizing stress during the trip.

Conclusion

Travel insurance might feel like an extra expense, but it’s actually an investment in security and peace of mind. From protecting your finances to ensuring you get medical care abroad, the right policy can make all the difference. Before your next adventure, take time to compare your travel insurance options—your future self will thank you.

✅ SEO Keywords:

- Travel Insurance Options

- Medical Emergencies Abroad

- Flight Cancellations and Lost Luggage

Frequently Asked Questions About Travel Insurance Options

1. Do I really need travel insurance for Europe?

Yes, travel insurance is strongly recommended for Europe. Many countries require proof of medical coverage for visa applications, and healthcare costs can be very high if you face an emergency abroad. Having coverage ensures peace of mind.

2. What does travel insurance cover in case of flight cancellations?

Most travel insurance policies cover flight cancellations and delays caused by bad weather, strikes, or emergencies. This means you can get reimbursed for hotel stays, meals, and rebooking costs.

3. Does travel insurance cover lost luggage?

Yes. If your luggage is lost, stolen, or delayed, your policy can reimburse you for essentials like clothes, toiletries, and replacements. This makes it easier to continue your trip without stress.

4. Can I get travel insurance just for medical emergencies abroad?

Absolutely. Some providers offer medical-only travel insurance, which focuses on covering healthcare costs like hospital stays, doctor visits, and emergency evacuation while traveling internationally.

5. Is multi-trip travel insurance worth it?

If you travel more than twice a year, a multi-trip annual policy can save you money. It offers continuous coverage across all your trips, so you don’t need to buy separate insurance each time.