Hilton Sees Global Opportunity Despite US Revenue Dip: European Gains and Corporate Travel Recovery Offer Hope

Hospitality giant Hilton Worldwide reported a slight downturn in U.S. business transient travel revenue in the second quarter of 2025, reflecting a broader trend of economic caution and shifting travel behavior. However, strong performance across European markets and an improving outlook in corporate bookings suggest that the company may be poised for a global rebound in the coming months.

Hilton’s Q2 earnings revealed a 2% year-on-year decline in U.S. business transient revenue per available room (RevPAR)—a key performance metric. CEO Christopher Nassetta, speaking during Wednesday’s earnings call, cited reduced U.S. government travel, weakened international inbound demand, and macroeconomic uncertainty as major contributors to the downturn.

Adding to the complexities was the calendar shift of Easter from Q2 2024 to Q2 2025, which impacted seasonal travel and skewed year-over-year comparisons. Nassetta also noted that new U.S. tariff policy discussions and implementation delays led to temporary pauses in corporate travel plans during the spring.

“The April through June period felt like a bit of a freeze,” said Nassetta, “but we’re starting to see encouraging signs of recovery, particularly in group and corporate business segments.”

Corporate Travel Sees Momentum Amid Mixed Metrics

Despite softness in the U.S., Hilton’s global business landscape shows signs of resilience. According to Nassetta, several key trends support cautious optimism:

- Sequential month-over-month growth in corporate leads

- Improved sentiment from U.S. airlines, with major carriers reporting strong Q2 earnings

- An uptick in group travel bookings and meetings demand

Internal lead volumes for company meetings were reported to be on the rise, reinforcing expectations that the “wait and see” approach among businesses might be giving way to renewed travel planning for H2 2025.

Hilton’s Global RevPAR Snapshot

For the second quarter overall, Hilton’s systemwide RevPAR declined slightly by 0.5% year-over-year, landing at $121.79, just under its earlier “flat” projection. Systemwide occupancy fell by 0.5 points to 74.4%, while average daily rate (ADR) nudged up 0.2% to $163.78.

Notably, Europe outperformed other regions:

- RevPAR in Europe rose by 2% year-on-year to $137.16

- Occupancy increased to 77.2%, up 0.8 points

- ADR climbed 0.9% to $177.64

This stands in contrast to Hilton’s U.S. performance, where RevPAR declined by 1.5% to $131.66, with occupancy falling to 75.8% and ADR slipping to $173.61.

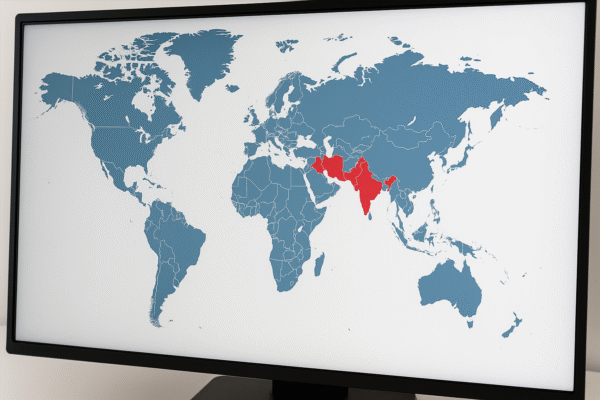

The disparity highlights Europe’s role as a stabilizing force in Hilton’s portfolio, benefiting from sustained intra-European tourism, a rebound in corporate travel, and favorable economic sentiment across core markets like France, the UK, and Germany.

Full-Year Outlook: Stable to Slight Growth

Looking ahead, Hilton forecasts flat to 2% RevPAR growth for full-year 2025, reflecting the balancing act between persistent headwinds in the U.S. and opportunities abroad. The company’s third-quarter RevPAR is expected to remain flat or modestly decline on a currency-neutral basis.

Still, total revenue in Q2 surpassed $3.1 billion, marking a 6% year-on-year increase, demonstrating Hilton’s capacity to generate top-line growth despite uneven demand.

Global Development Pipeline and New Openings

Hilton continues to advance its strategic expansion goals, with a robust pipeline of properties under development. As of the end of Q2, Hilton’s development pipeline included over 510,600 rooms, up 4% from 2024.

In the second quarter alone, Hilton opened 221 hotels globally, with standout debuts including:

- Sax Paris, part of the luxury LXR Hotels & Resorts collection

- The Marcus Portrush in Northern Ireland

- Hotel Astoria Vienna, expanding Hilton’s Austrian footprint

These additions underscore Hilton’s focus on diversifying its global portfolio, particularly in key cultural and business hubs across Europe.

Strategic Focus: Long-Term Resilience

Hilton’s long-term strategy continues to prioritize geographic diversification, brand strength, and a wide range of guest offerings—from premium business hotels to leisure-driven luxury properties. The company is also investing in digital innovation, sustainability upgrades, and personalized guest experiences, particularly across its Waldorf Astoria, Conrad, and Canopy brands.

Furthermore, Hilton has leveraged partnerships with local developers and tourism authorities to identify high-potential locations, especially in underserved secondary cities and high-growth destinations across Asia, Europe, and Latin America.

Conclusion: Rebounding with Cautious Optimism

While U.S. economic softness and lower government travel spending continue to pressure Hilton’s business transient segment, strong European performance and corporate travel revival offer encouraging signs. The company’s ability to maintain top-line growth and expand its footprint, even in a mixed-demand environment, reflects its operational strength and global brand appeal.

Hilton’s leadership remains confident that the second half of 2025 will bring more stability and opportunities for growth—both in recovering markets like the U.S. and in outperforming regions like Europe and parts of Asia.

As travelers resume meetings, events, and international journeys, Hilton’s well-positioned portfolio is set to benefit, reinforcing its stature as one of the world’s leading hospitality companies.

For more travel news like this, keep reading Global Travel Wire