The Asia-Pacific hospitality sector is showing signs of resilience in 2025 despite ongoing global economic uncertainty. Investors are pouring capital into hotel assets across the region, with Thailand emerging as one of the standout markets. Industry data suggests that by the end of the year, Thai hotel acquisitions will reach an estimated 20 billion baht, underscoring the country’s growing appeal as a premier investment destination.

While overall hotel investment in the region fell 23% compared to the previous year, totaling around US$4.7 billion, Thailand’s market is moving in the opposite direction. This surge has been fueled by rising confidence in the country’s tourism recovery and its strong potential for long-term growth.

Thailand’s Market Momentum

During the first half of 2025, Thai hotel transactions amounted to approximately US$301 million. By year-end, this figure is projected to more than double, reaching US$650 million, equivalent to over 20 billion baht. The sharp rise highlights Thailand’s growing prominence in hospitality investments, rivaling traditional heavyweights such as Japan, China, and Australia.

Several factors underpin this growth. Thailand’s resilient tourism sector continues to draw millions of visitors, with Bangkok and coastal destinations leading the way. The country’s strategic positioning within Southeast Asia, coupled with supportive government initiatives, has made it an attractive environment for both domestic and international investors.

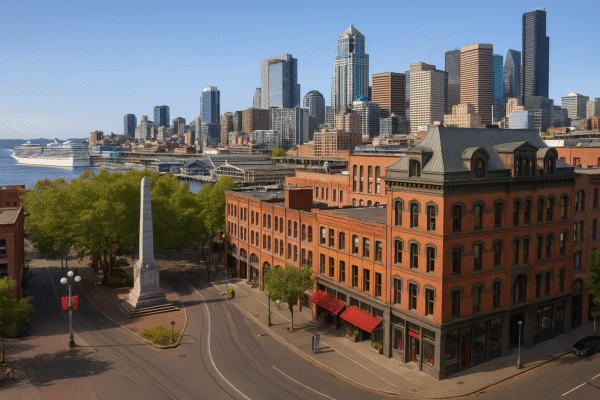

Bangkok: The Epicenter of Hospitality Investments

Bangkok remains the heart of Thailand’s hotel investment market. As both a global tourism magnet and a major business hub, the capital city offers diversified revenue streams that appeal to investors. Hotels in Bangkok benefit from year-round demand, fueled by international tourists, domestic travelers, and corporate clients attending events and conferences.

The liquidity of the Bangkok hotel market has attracted significant capital flows, making it one of the most competitive cities for transactions in the region. Beyond its strong infrastructure and connectivity, Bangkok’s dual role as a leisure and business destination enhances its resilience, ensuring steady returns even during fluctuating global conditions.

The Rise of High-Net-Worth Individuals in Hospitality

One of the most notable trends in 2025 has been the growing influence of high-net-worth individuals (HNWIs) in Thailand’s hotel market. Traditionally dominated by institutional investors, the sector is witnessing a shift toward private investors who are more agile in decision-making and willing to take calculated risks.

HNWIs are not only acquiring hotel assets but are also actively involved in value creation. From financing renovations to introducing innovative management strategies, these investors are reshaping the hospitality landscape. Compared to the previous year, HNWI hotel investments in Thailand have grown by more than 50%, signaling a decisive shift in the structure of capital flows.

This development reflects a broader trend across Asia-Pacific, where private investors are increasingly playing a central role in hotel acquisitions. Their flexibility and entrepreneurial approach are injecting fresh momentum into markets like Thailand, where opportunities for development and repositioning remain abundant.

Why Thailand Stands Out in Asia-Pacific

Despite global headwinds such as fluctuating interest rates and geopolitical uncertainty, Thailand has maintained a robust hospitality outlook. Government-backed tourism campaigns, coupled with continued infrastructure upgrades in airports and transportation networks, have supported the sector’s momentum.

While Japan, China, and Australia remain the region’s largest and most established hotel investment markets, Thailand’s resilience is drawing attention as a promising secondary market. The nation’s ability to attract both traditional institutions and private investors highlights its balanced appeal.

Bangkok, Phuket, and Chiang Mai stand out as key destinations, combining cultural heritage, leisure appeal, and modern amenities. With record visitor arrivals projected in the coming years, hotel occupancy and revenues are expected to remain strong, reinforcing investor confidence.

Market Shifts and Long-Term Outlook

The transformation of Thailand’s hotel investment landscape is being shaped by two critical factors: the rising role of private investors and the growing focus on long-term sustainability.

Private investors, particularly HNWIs, are pursuing innovative strategies to maximize returns. This includes integrating sustainable practices, such as energy-efficient building designs, and adopting technology to enhance guest experiences. These efforts align with global hospitality trends, where sustainability and digitalization are key drivers of competitiveness.

Looking ahead, Thailand is expected to remain at the forefront of Asia-Pacific’s hospitality growth. With international tourist arrivals on the rise and new infrastructure projects underway, the hotel market is well positioned to deliver consistent returns. The growing influence of private investors will likely accelerate this transformation, ensuring that Thailand remains a top destination for global capital.

Tourism and Economic Benefits

Beyond the financial aspects, the surge in hotel acquisitions carries broader implications for Thailand’s economy. New investments support job creation, boost local businesses, and enhance the country’s international profile as a tourism leader.

The development of high-quality hotel assets in Bangkok and other destinations contributes directly to the visitor experience, encouraging repeat travel and longer stays. As Thailand positions itself as a hub for both leisure and business tourism, the hospitality sector will play a crucial role in driving sustainable economic growth.

Conclusion: A Bright Future for Thailand’s Hotel Market

Thailand’s hotel investment boom in 2025 underscores the country’s rising importance in Asia-Pacific’s hospitality sector. With acquisitions expected to surpass 20 billion baht, the market reflects strong investor confidence, driven by resilient tourism and favorable government support.

The increasing participation of high-net-worth individuals and private investors marks a significant shift in strategy, bringing fresh energy and innovation to the market. Bangkok continues to lead as the epicenter of transactions, while secondary destinations are also gaining momentum.

As Asia-Pacific hotel investments evolve, Thailand stands out as a dynamic and promising market. With a strong foundation in tourism, robust growth prospects, and diverse investor participation, the country’s hospitality industry is poised for long-term success.

For more travel news like this, keep reading Global Travel Wire