Tourism Jobs Rise Sharply in June

The global tourism industry showed remarkable strength in June 2025 as employment rose by 1.4%. This sharp increase in hiring reflects strong business confidence and the readiness of tourism operators to meet summer travel demand. From hotels and resorts to restaurants, airlines, and attractions, businesses are preparing for record levels of tourism activity across major destinations. Seasonal employment has also surged, ensuring that staffing levels meet peak travel season needs.

The resilience of global tourism employment highlights the sector’s ability to recover from recent economic uncertainty. Hiring momentum demonstrates that tourism remains one of the fastest-growing industries worldwide, supporting millions of jobs and generating significant economic activity.

Unemployment Holds Steady at 4.1%

Tourism unemployment levels remained unchanged at 4.1% in June, a sign of stability within the sector. This steady rate shows that businesses are not only creating new roles but also successfully retaining staff. Such stability is crucial for service quality, as trained employees provide consistent experiences for travelers.

For workers, low unemployment signals career stability and growth opportunities in tourism-related industries. For employers, it means a competitive labor market where attracting and retaining talent requires higher wages, better benefits, and career development programs.

Wages Outpace Inflation, Boosting Consumer Spending

Another positive sign for the tourism sector is wage growth. In June, hospitality and tourism wages grew faster than inflation, exceeding it by 101 basis points. This gives workers higher real income, boosting their spending power.

When consumers have more disposable income, they are more likely to book vacations, enjoy dining experiences, and participate in leisure activities. This normally creates a positive cycle for tourism demand, fueling hotel bookings, restaurant traffic, and attraction visits. However, while wages are supporting consumer spending, the benefits are not evenly distributed across all travel segments.

Real Disposable Income Growth Slows

Despite wages outpacing inflation, the overall pace of real disposable income growth has slowed. Rising living costs, debt obligations, and shifting spending priorities are influencing how travelers allocate their budgets.

While many people continue to travel, they are becoming more selective. Shorter stays, mid-range hotels, and value-for-money packages are replacing extended luxury vacations. This shift in behavior helps explain why hotel revenues are not growing at the same rate as job creation and wage increases.

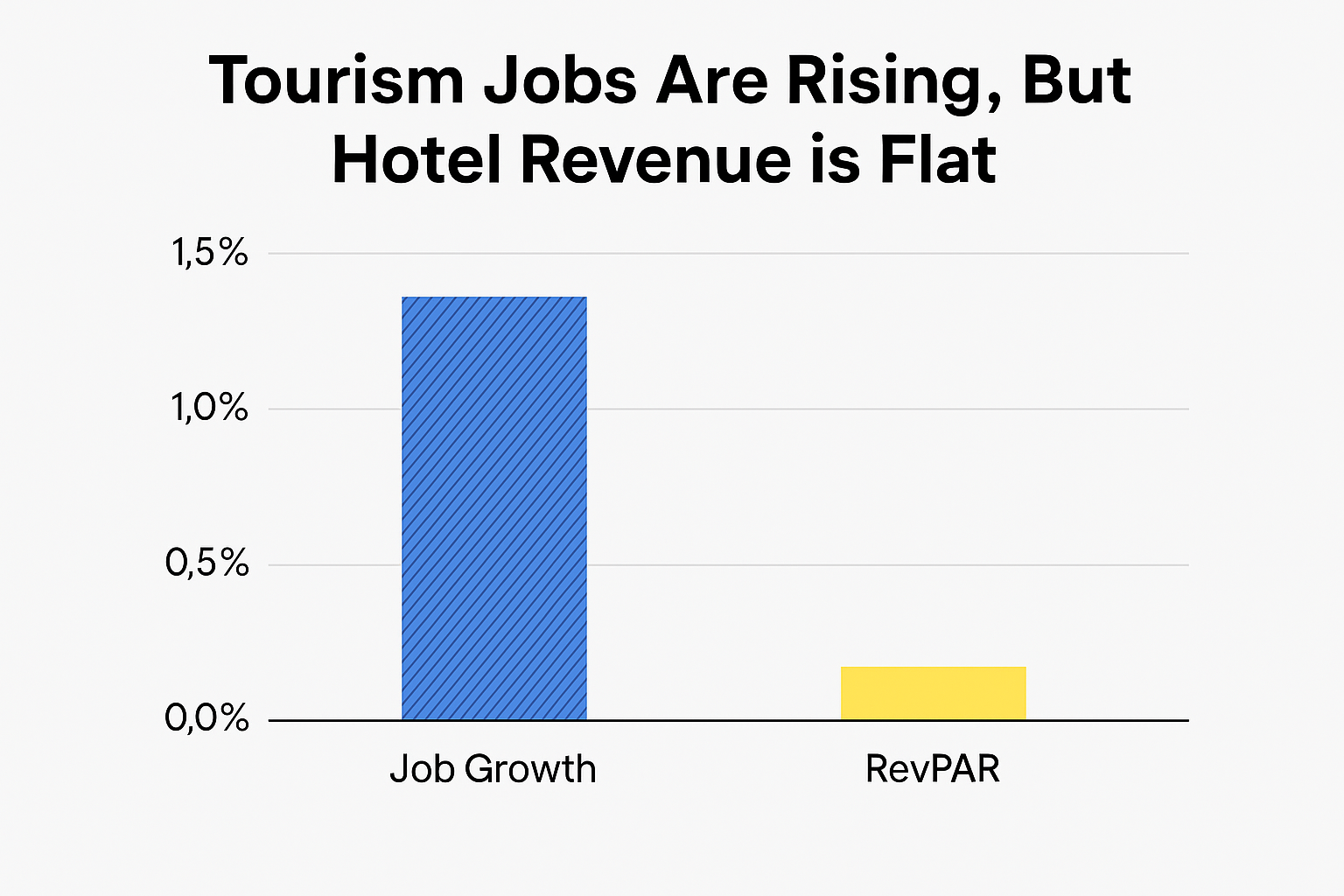

Hotel RevPAR Growth Stalls

Revenue per available room (RevPAR), a key profitability measure for hotels, has failed to accelerate despite increased demand. This suggests that while more guests are traveling, hotels are struggling to increase room rates or occupancy enough to drive revenue higher.

Heavy competition, price discounting, and high operating expenses are limiting profitability. Even with full rooms, revenue growth is modest due to promotional rates and rising costs in labor, energy, and supplies.

Shifting Travel Patterns and Consumer Choices

Global demand for travel remains strong, but travelers are increasingly budget-conscious. Tourists are choosing mid-market hotels, short city breaks, and package deals that maximize value. This change in consumer behavior benefits budget and mid-range hospitality providers more than high-end resorts.

Luxury hotels, while still attractive to affluent travelers, are facing pressure to justify higher rates. To compete, they are offering added value such as wellness packages, culinary experiences, and personalized services.

Rising Costs Challenge Hospitality Operators

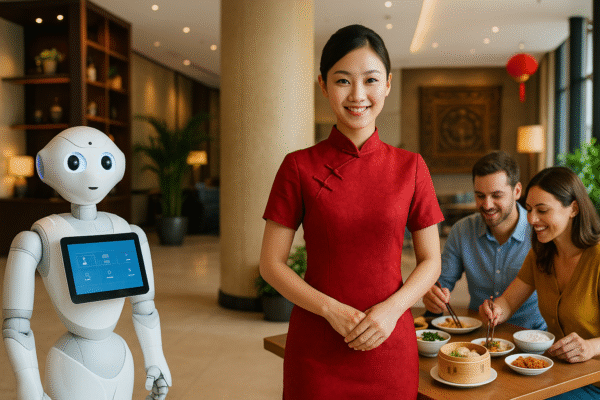

The growth in wages, while positive for workers, is increasing operating costs for businesses. Combined with high utility prices and supply chain expenses, many hospitality operators face shrinking profit margins.

To remain competitive, hotels and tourism operators are adopting technology-driven efficiency solutions, such as automated booking systems, AI-driven guest services, and energy-efficient operations. These measures aim to reduce costs while maintaining service quality.

Bridging the Gap Between Jobs and Profitability

The current tourism landscape shows a clear disconnect: jobs and wages are rising, but profitability measured by RevPAR is not. For the industry to thrive, businesses must turn higher demand into stronger financial performance.

Hotels are exploring dynamic pricing strategies, upselling premium services, and offering personalized packages to boost revenue. Partnerships with local attractions and cultural experiences also create opportunities to increase guest spending.

Outlook for 2025: Strong Demand but Pressure on Hotels

The second half of 2025 looks promising for global tourism, with strong travel demand expected during peak holiday seasons. Employment growth will continue to strengthen local economies, while higher wages support consumer confidence.

However, success for hotels will depend on their ability to adapt. By balancing competitive pricing with innovative guest experiences, operators can capture more value from travelers. The challenge will be ensuring that wage-driven consumer spending translates into sustainable revenue growth.

For more travel news like this, keep reading Global Travel Wire