Edinburgh, Scotland – June 2025:

In a move reflecting growing caution among local authorities, Scotland’s Western Isles and South Ayrshire Councilshave officially paused their plans to implement a tourist tax, following public opposition and economic analysis. The proposals, which aimed to introduce a visitor levy to generate local revenue from tourism, are now under review as officials reconsider the potential impact on small businesses and visitor numbers.

The decisions mark a pivotal moment in Scotland’s broader tourism policy, where local governments are seeking a balance between funding local infrastructure and ensuring tourism remains sustainable and inclusive.

Western Isles Pause Visitor Levy Amid Economic Risk Assessment

The Comhairle nan Eilean Siar, governing the Western Isles, had been considering a tourist tax on overnight accommodation as part of a nationwide framework that allows councils to introduce visitor levies. The proposal was driven by a need to support local infrastructure and services, especially in areas where tourism puts additional pressure on resources.

However, a recent cost-benefit analysis presented to the council revealed that the economic advantages of the levy would be marginal at best. While the Western Isles welcomed 389,000 visitors in 2023—a 21.8% increase from 2022—officials found that the majority of accommodation is provided by small, self-catering businesses, which could be disproportionately affected by the levy.

The report further emphasized that such taxes might discourage longer stays or reduce repeat visits, potentially impacting the fragile local economy that depends on tourism. With over 1,246 small-scale providers offering around 7,900 beds, the region’s tourism ecosystem is dominated by family-run businesses and independent operators with limited capacity to absorb new costs.

As a result, the Comhairle nan Eilean Siar decided to delay implementation and explore alternative funding mechanisms, including a point-of-entry tax levied at ports and airports. This approach would avoid placing the burden directly on local hospitality businesses while still generating tourism-related revenue.

The pause follows similar decisions by councils in Orkney and Shetland, where concerns over the economic and social impact of visitor levies have led to broader reconsideration.

South Ayrshire Council Drops Tourist Tax Plan After Public Rejection

In South Ayrshire, a proposed tourist tax targeting overnight stays has been officially abandoned after a public consultation revealed overwhelming opposition. According to council data, 79% of respondents opposed the tax, while only 15% supported it. Concerns focused on the potential for the levy to discourage tourists, increase costs for families, and impact local hospitality businesses still recovering from the pandemic.

Initially proposed to boost post-COVID revenue and support rising service costs, the plan faced significant backlash from both residents and tourism stakeholders.

Acknowledging the public sentiment, the South Ayrshire Council emphasized the importance of keeping the region attractive to both domestic and international visitors. Officials stated that any measure that could jeopardize tourism recovery or harm small businesses was not viable under current economic conditions.

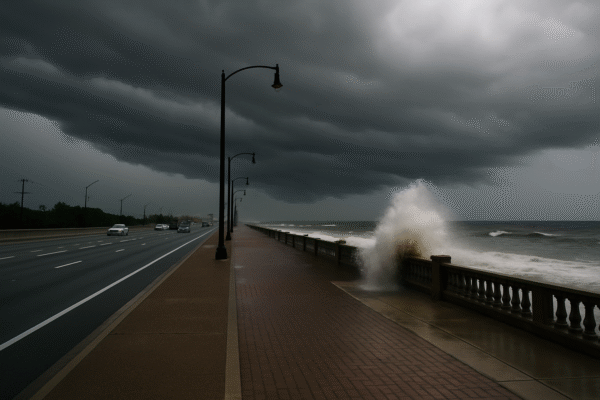

South Ayrshire, known for its scenic coastline, golf resorts, and cultural heritage, relies heavily on tourism. The council reiterated its commitment to supporting the sector with alternative strategies that do not impose additional financial burdens on travelers or local businesses.

Wider Debate Over Tourism Taxation in Scotland

The decisions in the Western Isles and South Ayrshire come amid a broader national and European debate on the role of tourist taxes in sustainable tourism development. Across Scotland, tourism numbers are steadily rising thanks to growing interest in wellness, nature, and heritage-based travel. While many local authorities see visitor levies as a way to manage infrastructure strain and fund community services, others warn of economic risks and reputational damage.

Scotland’s national tourism board, VisitScotland, has emphasized the importance of collaborative planning between local governments, businesses, and communities. There is growing recognition that a one-size-fits-all approach to tourism taxation may not be effective, especially in rural or island communities where the tourism economy is more delicate.

Point-of-Entry Tax: A Possible Alternative?

The idea of a point-of-entry levy—charged at transport hubs like ferry terminals or airports—is gaining traction as a more equitable solution. Unlike traditional accommodation-based tourist taxes, this model would capture revenue at the moment of arrival, potentially reducing administrative burdens and spreading costs more evenly.

Proponents argue that such a model would:

- Avoid targeting local small businesses

- Be easier to manage centrally

- Capture all visitors, not just overnight guests

- Be less visible and less intrusive to travelers

However, implementation challenges remain, including questions over enforcement, system infrastructure, and the need for national legislation to authorize and manage such schemes.

Conclusion: A Measured, Consultative Path Forward

The pauses in Western Isles and South Ayrshire reflect a careful and consultative approach to managing tourism growth. While the concept of a visitor levy remains on the table in some parts of Scotland, these latest decisions underscore the importance of community support, economic viability, and stakeholder consensus.

As Scotland navigates a future of rising visitor numbers and evolving traveler expectations, policymakers are urged to design tourism funding mechanisms that are both sustainable and inclusive. The challenge lies in supporting local infrastructure and services without compromising affordability or alienating travelers.

With continued dialogue, creative alternatives like entry-based levies or voluntary contributions may offer a pathway that meets both public and economic needs. For now, the message from local communities is clear: tourism policies must be developed with—and not just for—the people they affect.

For more travel news like this, keep reading Global Travel Wire