Canadian Tourists Fueled $20.5 Billion in U.S. Revenue—But 2025 Boycott Threatens Major Travel Disruption

In 2024, Canadian travelers played a defining role in the United States tourism economy, making nearly 20 million visits and spending a collective $20.5 billion, according to recent data from the U.S. Travel Association. This influx supported an estimated 140,000 American jobs across the hospitality, transport, and retail sectors, reaffirming Canada as the single largest international travel market for the U.S.

But 2025 is already showing signs of turbulence. A growing Canadian boycott of U.S. destinations—fueled by political, safety, and social concerns—is leading to a sharp decline in bookings, signaling a major realignment of North American tourism flows.

Canada: The Cornerstone of U.S. Inbound Tourism

With a population of approximately 40 million, Canada accounted for 26% of all international visitors to the United States in 2024. Popular destinations for Canadian tourists included Florida, California, New York, and border towns like Buffalo and Detroit. Their frequent visits were driven by shared culture, geographic proximity, and economic ties.

Traditionally, Canadian tourists have been reliable year-round contributors, visiting for shopping trips, sports events, family reunions, and warm-weather escapes. Their consistent presence has provided a financial cushion to many U.S. states, especially in border regions and snowbird destinations.

However, these patterns are shifting dramatically in 2025.

Why Are Canadians Boycotting U.S. Travel in 2025?

Several factors have triggered what Canadian travelers and media are now calling a “soft boycott” of the U.S.:

- Gun violence and safety concerns, especially in large American cities

- Perceived hostility at the border, with travelers reporting increased scrutiny and detainment

- Political divisions and restrictive laws, including on health care, LGBTQ+ rights, and immigration

- Favorable exchange rates and travel incentives elsewhere, including in Canada and Europe

This boycott isn’t officially government-mandated, but it has gained traction through social media movements like #BoycottUSA and advocacy from Canadian travel influencers encouraging people to “travel local or go global—just not south.”

A poll by Ipsos Canada in early 2025 found that 31% of Canadians now avoid traveling to the U.S. due to social or political reasons, a figure that has nearly doubled since 2022.

U.S. Regions Hit Hard by Canadian Tourism Decline

Border states like Michigan, Vermont, and Washington are already seeing economic impacts. Cities such as Buffalo, NY, and Bellingham, WA, which rely on Canadian day-trippers and weekend shoppers, are reporting reduced retail foot traffic and lodging occupancy.

In Florida, where hundreds of thousands of Canadian “snowbirds” spend the winter, tourism boards are revising economic forecasts amid lower reservation volumes from Quebec and Ontario.

“We’ve built infrastructure and businesses around this dependable influx of Canadian tourists,” said a tourism officer from Fort Lauderdale. “A prolonged downturn could have serious consequences.”

European Tourists Now Choosing Canada Over the U.S.

As Canadian tourism to the U.S. cools, Canada itself is seeing a sharp rise in international visitors, especially from Europe. According to Destination Canada, European arrivals grew by over 17% year-over-year in Q1 2025, with travelers opting for culturally rich and politically stable destinations like Montreal, Vancouver, and the Canadian Rockies.

A report from the World Travel & Tourism Council (WTTC) suggests that many European travelers who previously considered U.S. holidays have been drawn to Canada’s safer image, natural beauty, and less divisive social climate.

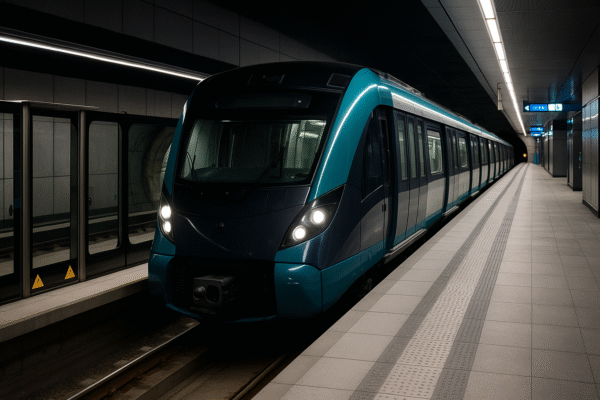

Travel agencies in France, Germany, and the UK report increased interest in Canadian rail journeys, national parks, and culinary tourism—areas where the U.S. once held a strong competitive edge.

Financial Fallout for the United States

The loss of Canadian travelers in 2025 is more than symbolic—it represents a substantial economic setback. Analysts estimate that even a 15% drop in Canadian visitation could result in a multi-billion-dollar shortfall for the U.S. economy, particularly in the tourism and hospitality sectors.

Jobs in airports, hotels, restaurants, car rentals, and theme parks may be at risk in areas dependent on cross-border travel. Small towns with border crossings are already seeking federal or state aid to cushion the blow from declining visitor numbers.

Meanwhile, the U.S. is seeing reduced engagement from some European markets, partly due to high airfare, visa barriers, and perceptions of declining safety.

What Comes Next: Rebuilding Confidence Across Borders

To counter the trend, U.S. tourism boards are ramping up marketing efforts targeting Canadians. New campaigns from Visit California, Discover Miami, and NYC Tourism are focused on reassuring Canadians of safety, value, and inclusivity.

Some policymakers are also pushing for simplified border procedures and increased diplomatic outreach to reestablish confidence among Canada’s travelers.

“Rebuilding the trust of our northern neighbors is not only about tourism—it’s about shared values, convenience, and mutual respect,” said Geoff Freeman, CEO of the U.S. Travel Association.

Conclusion: Canada Rises as U.S. Reassesses Its Tourism Future

In the evolving North American tourism landscape, Canada is emerging as an international tourism hotspot—drawing in Europeans while retaining domestic travel dollars once earmarked for the U.S.

Meanwhile, the United States faces a pivotal moment. Losing its most loyal international visitor base to dissatisfaction and geopolitical shifts underscores the need for policy reflection, targeted outreach, and renewed hospitality.

Whether this is a temporary correction or the start of a long-term transformation remains to be seen. But one thing is certain: the tourism ties between Canada and the U.S. are being tested like never before.

For more travel news like this, keep reading Global Travel Wire