Singapore Emerges as Southeast Asia’s Premier Luxury Retail Hub, Surpassing China, Japan, and South Korea in New Store Openings

Singapore has solidified its position as Asia’s fastest-growing luxury shopping destination, overtaking traditional powerhouses like China, Japan, and South Korea in new high-end store openings. As global luxury brands recalibrate their Asia strategy amid shifting market dynamics, the city-state’s stable economy, affluent consumer base, and thriving tourism sector have placed it at the center of regional retail expansion.

According to a 2024 report by Savills, Singapore ranked third among 32 Asia-Pacific cities outside mainland China for new luxury store launches. This momentum is supported by favorable business policies, world-class infrastructure, and a robust base of wealthy residents and high-spending visitors. The Singapore Tourism Board (STB) reported a 5% year-over-year increase in tourist retail spending, highlighting the city’s growing appeal as a luxury shopping destination.

Luxury Sales Forecast to Surpass US$10.9 Billion in 2025

Backed by rising domestic income and a surge in affluent arrivals, Singapore’s luxury market is on track to generate S$13.9 billion (US$10.9 billion) in 2025, a 7% year-on-year growth, according to Euromonitor International. Analysts expect the market to exceed its pre-pandemic peak of S$14.7 billion by 2026, reflecting a remarkably resilient retail recovery in the face of global economic uncertainties.

This growth puts Singapore ahead of regional heavyweights, including Tokyo, Seoul, and even Hong Kong, where luxury spending has plateaued due to regulatory changes and macroeconomic headwinds.

Global Brands Double Down on Experiential Retail

Luxury brands are not just opening more stores—they’re investing in immersive, experience-led flagships that cater to the evolving preferences of discerning consumers. In 2024, a leading French jeweler launched a flagship boutique and curated exhibition gallery within the historic Capitol Kempinski Hotel, while a renowned Swiss watchmaker debuted its first Southeast Asian flagship, also within the property. Designed with residential-style interiors and an in-house luxury café, the boutique offers an elevated retail experience tailored to ultra-high-net-worth individuals.

Elsewhere, ION Orchard—Singapore’s high-end shopping epicenter—hosted 21 luxury brand activations in a single year. Pop-up showcases from Chanel, Dior, Gucci, and other fashion giants captivated both locals and tourists, blending retail, beauty, and art in interactive spaces.

A Compact City with a Global Retail Footprint

Measuring just 280 square miles, Singapore punches far above its weight in luxury retail rankings. Its third-place position among Asia-Pacific cities for new store openings is especially notable given its modest population of six million. The city’s political stability, investor-friendly climate, and tax incentives for high-net-worth individuals contribute to its magnetism for global luxury brands seeking Southeast Asian footholds.

Wealth Hub Status Reinforced by Global Rankings

Singapore’s status as a financial and luxury epicenter is underpinned by its standing in the World’s Wealthiest Cities Report 2025, which ranked the city fourth globally for millionaire residents. The report lists 242,400 millionaires, including centi-millionaires and billionaires, who contribute significantly to the city’s premium spending patterns.

Alongside rising affluence, median household income has grown steadily, according to data from the Ministry of Manpower, supporting strong domestic demand for designer fashion, luxury watches, and high-end cosmetics.

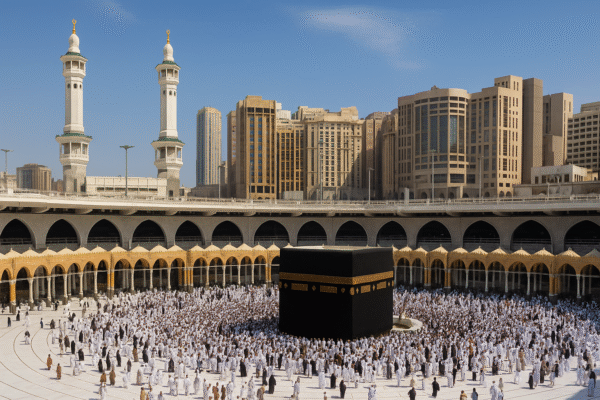

Tourism-Fueled Luxury Spending Soars

International tourism remains a vital pillar of Singapore’s luxury economy. The STB reported S$3.9 billion in tourist retail spending between January and September 2024, up 5% from the same period in 2023. Key visitor markets include Indonesia, China, Australia, India, and the U.S.—many of whom arrive seeking curated shopping experiences in landmark malls such as Marina Bay Sands, The Shoppes, and Paragon.

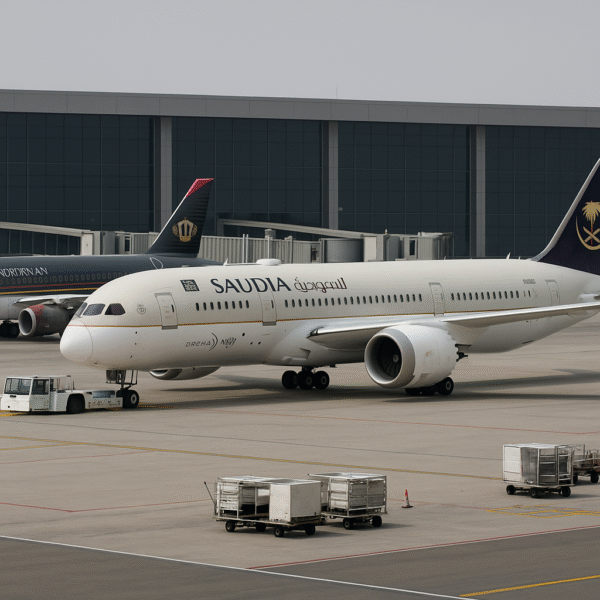

With Singapore Changi Airport continuing to rank among the world’s best and most connected aviation hubs, inbound visitor flows are expected to rise further, reinforcing the luxury retail sector’s growth trajectory.

A Strategic Gateway for Regional Luxury Expansion

As China faces slower luxury growth due to shifting consumer behavior and regulatory constraints, Singapore offers global brands a stable, well-regulated springboard into broader Southeast Asia. Its central geographic location, bilingual workforce, and streamlined customs and logistics systems make it an ideal operational base.

Leading luxury groups like LVMH, Richemont, and Kering are increasingly using Singapore as a launchpad for regional campaigns, pop-ups, and store rollouts.

Challenges: Limited Space, Slowing Inflows

Despite the upward trajectory, Singapore’s luxury sector does face obstacles. Chief among them is a tight premium retail real estate market. With limited development space in prime districts like Orchard Road and Marina Bay, brands may struggle to secure flagship locations without paying a significant premium.

Moreover, Henley & Partners projects a slowdown in net millionaire migration into Singapore in 2025, with inflows dropping to 1,600 individuals from 3,400 in 2024. Though the city remains a global wealth magnet, competition from rising hubs like Dubai and Sydney is increasing.

Singapore’s Luxury Future Remains Bright

Despite these hurdles, Singapore’s fundamentals remain exceptionally strong. A stable government, rising household incomes, surging tourism, and strategic international positioning ensure it will remain a leader in Asia’s luxury retail sector.

With brands embracing immersive, localized retail strategies and affluent consumers continuing to invest in high-end products, Singapore is poised to maintain its lead as Southeast Asia’s premier destination for luxury shopping and tourism.

For more travel news like this, keep reading Global Travel Wire