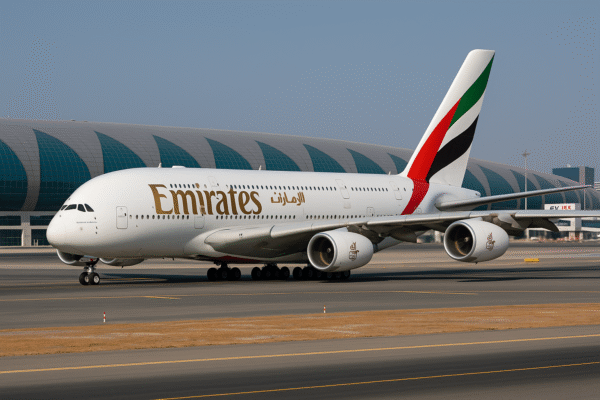

In a strategic move reaffirming its commitment to long-haul aviation and premium passenger service, Emirates has finalized the purchase of four Airbus A380 aircraft for a total of $177 million (£132 million). This acquisition marks a significant milestone in the airline’s fleet modernization and expansion strategy, with title transfers scheduled between August and November 2025.

Previously leased from Guernsey-based Doric Nimrod Air Three, the aircraft—bearing Manufacturer Serial Numbers (MSNs) 132, 133, 134, and 136—have been operating under Emirates since 2013. With the lease agreements set to expire this year, Emirates has chosen to buy the aircraft outright, reinforcing its position as the world’s largest operator of the Airbus A380.

Strategic Fleet Acquisition to Secure Operational Flexibility

Under the deal, Emirates will pay approximately $25 million per aircraft to acquire title ownership, with an additional $20 million covering final lease return obligations. This strategic buyout allows Emirates to avoid future leasing costs and gives the carrier full control over aircraft deployment and customization. It also opens the door for interior upgrades or tailored enhancements aligned with evolving passenger expectations on long-haul services.

The transaction is part of a broader fleet strategy that reflects Emirates’ confidence in the long-term viability of the A380 amid global shifts toward fuel-efficient aircraft. With a seating capacity of up to 850 passengers in an all-economy configuration, the A380 remains unparalleled in size and passenger comfort.

Maintenance and Transition Timeline

The first aircraft (MSN133) is slated for title transfer on 27 August 2025. Ahead of delivery, it will undergo standard scheduled maintenance at Emirates’ world-class engineering facility near Dubai International Airport (DXB). The remaining aircraft—MSNs 132, 134, and 136—will transition to full Emirates ownership by the end of November 2025.

Doric Nimrod Air Three, the investment company that facilitated the original aircraft leases, will liquidate in early 2026 following the completion of the sale and distribution of proceeds to shareholders.

Powering Global Routes with Engine Alliance GP7200 Engines

Each of the newly acquired A380s is powered by the Engine Alliance GP7200 engine, renowned for its fuel efficiency, low emissions, and high thrust performance. These engines significantly improve operational cost-efficiency while ensuring quieter and smoother flights. The GP7200 engine also contributes to the A380’s continued status as one of the most environmentally advanced wide-body aircraft in service.

For Emirates, this translates to better fuel economy, fewer emissions per passenger, and reliable performance on its most demanding long-haul routes—including transcontinental services between Dubai and major cities in Europe, North America, and Asia.

Emirates’ A380 Investment Strategy Defies Industry Trends

While numerous global carriers have begun retiring or scaling back their A380 fleets in favor of smaller, twin-engine aircraft, Emirates has taken the opposite route. The Dubai-based airline has doubled down on its investment in the superjumbo, maintaining over 100 A380s in active service—the largest such fleet globally.

Sir Tim Clark, President of Emirates Airline, has repeatedly affirmed the A380’s integral role in the carrier’s business model. Its two-deck configuration offers expansive cabin layouts, onboard lounges, private first-class suites, and generous baggage space—making it a favorite among premium and economy travelers alike.

Reinforcing Dubai as a Global Aviation and Tourism Powerhouse

Dubai International Airport (DXB) is currently the world’s busiest airport by international passenger traffic, and Emirates’ A380 fleet is pivotal in sustaining that dominance. By taking ownership of these four aircraft, Emirates strengthens its ability to serve high-demand markets efficiently, connect global travelers to and through Dubai, and support the UAE’s broader tourism and trade ambitions.

According to the UAE General Civil Aviation Authority (GCAA), Dubai’s aviation sector supports over 745,000 jobs and contributes more than $26 billion to the national GDP. The continued growth of Emirates and its A380 fleet is central to maintaining this momentum, particularly as Dubai targets 40 million tourists annually by 2031 under its national tourism strategy.

Operational Impact Across Key Global Routes

The four A380s will be redeployed across Emirates’ busiest long-haul routes, including London Heathrow, Sydney, New York JFK, Frankfurt, and Singapore. Full ownership means Emirates can modify seating configurations, introduce in-flight product enhancements, and better align fleet use with real-time demand trends across its 155-destination network.

With increasing global travel demand, especially in Asia-Pacific and European markets, the timing of this acquisition positions Emirates to capitalize on post-pandemic recovery and long-term passenger growth.

A Clear Signal of Long-Term Vision

This strategic purchase sends a clear message: Emirates is investing in long-haul travel for the long haul. By solidifying its fleet of A380s, the airline ensures operational consistency, premium service standards, and scalability to match future demand spikes. While others retreat from the A380 program, Emirates continues to lead it—proving that the superjumbo still has wings in the modern aviation landscape.

As Emirates prepares to welcome these aircraft into full ownership, the airline continues to position itself at the forefront of global aviation—connecting continents, fueling tourism, and reinforcing Dubai’s status as one of the world’s most important air hubs.

For more travel news like this, keep reading Global Travel Wire