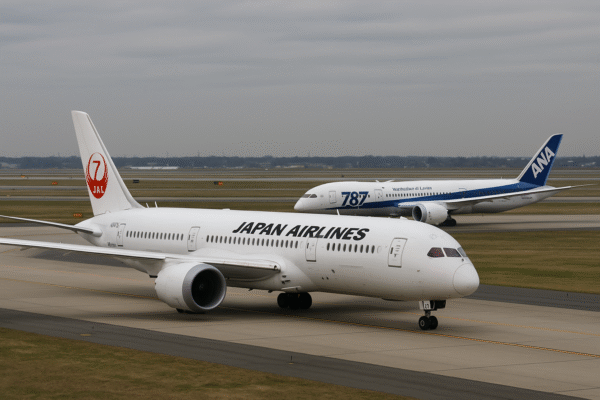

Japan Airlines (JAL) and All Nippon Airways (ANA) are experiencing a surge in demand as Japanese corporate travel to the United States grows rapidly. The trend has been fueled by tariff-driven shifts in global trade and manufacturing, with Japanese companies reassessing supply chains and expanding their U.S. presence.

Executives and professionals are increasingly booking long-haul flights, particularly in business and first-class cabins, boosting revenues for Japan’s flagship carriers. This wave of premium travel is reshaping flight schedules, route expansions, and strategic planning for both airlines.

Tariffs Reshape Travel and Manufacturing

Trade tariffs introduced under the Trump administration have significantly altered supply chains, prompting Japanese firms to diversify operations away from China and strengthen their foothold in North America. As a result, the United States has become a critical destination for Japanese executives, managers, and technical specialists.

Travel statistics confirm the shift. Business travel from Japan to the U.S. has increased sharply, with corporate bookings on transpacific routes climbing by double-digit percentages compared to the previous year. The Japan National Tourism Organization has also reported a broader rebound in outbound travel, with a 14% rise in overseas trips this year, further supporting the recovery of the aviation sector.

Corporate Travel Powers Airline Profits

Premium travel has become a cornerstone of profitability for Japan Airlines and ANA. JAL has reported its strongest operating profit since 2012, more than doubling its earnings compared to last year. Outbound corporate travel now accounts for more than 15% of its international revenue.

High-yield business class fares have enabled JAL to sustain elevated ticket prices, particularly on long-haul routes to U.S. destinations such as Los Angeles and Chicago. In response to rising demand, JAL has resumed the Narita–Chicago route and increased capacity by deploying larger aircraft on the Haneda–Los Angeles route.

ANA, while also benefiting from premium bookings, faces a more diversified international portfolio that includes weaker demand from European markets. Still, its transpacific services remain strong, with corporate travel providing a major boost to earnings.

Japanese Manufacturing Expands in the US

Behind the surge in travel is a wider transformation of Japan’s industrial presence in the United States. Leading manufacturers including Bridgestone, Honda, and Toyo Tire are expanding U.S. operations to offset tariff-related costs and meet growing demand in North America. Subaru has even described U.S. production expansion as “inevitable.”

This shift has intensified the need for corporate travel, as company executives and managers frequently shuttle between Japan and the U.S. to oversee operations, negotiate with partners, and finalize investments. Both JAL and ANA have been direct beneficiaries of this increased demand, particularly in premium cabins.

Strategic Airline Responses

Japan Airlines has taken aggressive steps to capture the boom in corporate travel. In addition to reintroducing high-demand routes, the airline has enhanced business-class capacity, investing in larger premium sections on select aircraft. The carrier is also expected to expand its North American network in the coming months.

ANA, though slightly constrained by weaker demand on some European routes, continues to refine its U.S. offerings. The airline has leaned on cargo services and broader international diversification but remains optimistic about sustaining strong transpacific growth. Both airlines recognize that the premium travel market is central to long-term profitability and competitiveness.

Financial Outlook and Industry Impact

JAL expects its second-quarter operating profit to climb to 72.1 billion yen (US$490 million), the highest since 2018. ANA’s first-half operating income is forecast to reach 62% of its annual target, reflecting resilience despite global uncertainties. Analysts predict that both airlines will raise their full-year forecasts if current demand continues.

The rise in corporate travel is also reinforcing Japan’s broader aviation recovery. While outbound leisure travel has yet to reach pre-pandemic levels, the corporate sector has provided stability and momentum. With Japanese companies accelerating U.S. investments, business travel is expected to remain strong well into 2025.

A Perfect Storm for Growth

The convergence of shifting global trade dynamics, manufacturing expansion in the United States, and pent-up post-pandemic travel demand has created ideal conditions for JAL and ANA. Both airlines are positioned as leaders in premium travel, with strategies focused on long-haul routes and business-class innovation.

As tariffs and supply chain restructuring continue to drive Japanese corporate presence in North America, business travel is likely to remain elevated. For Japan Airlines and ANA, the outlook is one of sustained growth, route expansion, and increased focus on premium passengers.

Final Thoughts

Japan Airlines and All Nippon Airways are reaping the rewards of a historic shift in global trade that has strengthened corporate ties between Japan and the United States. With premium bookings soaring, both carriers have adapted quickly, expanding transpacific services and reinforcing their leadership in the aviation sector.

As Japanese companies deepen their U.S. investments, the demand for executive travel will continue to climb. For JAL and ANA, the skies ahead are not only busy but highly profitable, marking a new era of growth in international aviation.

For more travel news like this, keep reading Global Travel Wire