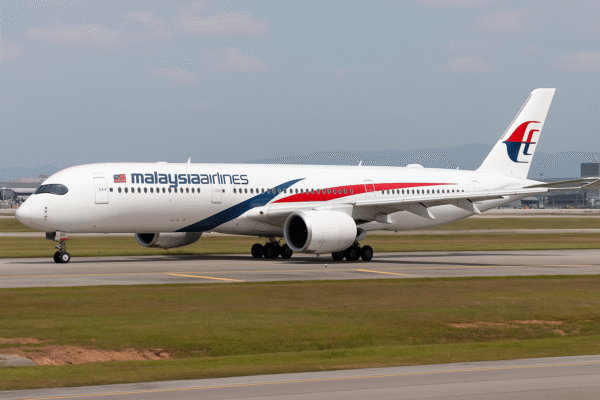

In a dramatic response to ongoing financial distress, U.S.-based low-cost airline JetBlue Airways has confirmed a major reduction in flight operations and aircraft activity, marking one of the most significant retrenchments in the American airline industry this year. The airline is facing a double blow—escalating operational costs and weaker-than-expected travel demand—forcing it to implement wide-ranging cost-cutting measures to navigate a turbulent fiscal landscape.

JetBlue’s CEO Joanna Geraghty recently issued an internal memo stating that achieving a break-even operating margin in 2025 is no longer realistic, as the company struggles with high expenses and operational inefficiencies. The announcement has sent ripples across the aviation industry, raising serious questions about JetBlue’s long-term stability and strategic direction following a blocked merger with Spirit Airlines earlier this year.

Aircraft Groundings and Rising Maintenance Costs

A critical factor compounding JetBlue’s woes is the ongoing issue with Pratt & Whitney’s Geared Turbofan (GTF) engines, which power a significant portion of JetBlue’s fuel-efficient Airbus A321neo and A220 fleet. Required inspections and repairs have led to the grounding of multiple aircraft, significantly impacting route availability and increasing operating expenses.

- Several A321neo and A220 aircraft remain out of service and are expected to stay grounded well into 2025.

- These aircraft are among the most fuel-efficient in JetBlue’s fleet, and their absence is forcing the airline to operate older, less efficient planes.

- The lack of available aircraft has caused schedule disruptions, a reduction in available seat miles (ASMs), and higher per-unit operating costs.

This development couldn’t come at a worse time, as JetBlue faces increasing pressure to streamline costs and preserve liquidity.

The Fallout of the Spirit Airlines Merger Collapse

JetBlue’s plan to merge with Spirit Airlines—announced in 2022 as a bold move to expand scale and reduce unit costs—was struck down by a federal court in early 2025. The failed JetBlue-Spirit merger was meant to help JetBlue compete more effectively against legacy carriers by expanding its national footprint and achieving economies of scale.

Instead, the merger’s collapse has left JetBlue:

- Without access to Spirit’s low-cost network and aircraft,

- Burdened by legal fees and lost strategic momentum, and

- Facing the reality of remaining a smaller player in an intensely competitive U.S. market.

The airline is now reevaluating its growth strategy as it seeks to control expenditures without the expanded resources the merger would have provided.

Strategic Adjustments: Cost-Cutting Measures Intensify

In response to these challenges, JetBlue has launched a suite of aggressive cost-saving initiatives aimed at stabilizing the company and preserving cash flow.

Among the measures:

- Postponement of 44 new Airbus aircraft deliveries, reducing capital expenditures by $3 billion through 2029.

- Grounding of six Airbus A320s that were scheduled for interior retrofits.

- Refocusing on core profitable routes while cutting underperforming services, including some transcontinental and leisure-oriented flights.

- Freezing non-essential hiring and revisiting vendor contracts to reduce fixed expenses.

JetBlue aims to tighten its route network, ensuring aircraft utilization aligns with the most revenue-generating segments.

Investor Concerns Mount as Stock Falls

Investor confidence in JetBlue has significantly eroded, with the airline’s stock dropping over 42% year-to-date. The market is reacting not only to near-term earnings pressures but also to uncertainty over JetBlue’s strategic direction.

- Analysts are flagging structural issues, including limited global reach and increasing reliance on domestic leisure travel.

- The failed merger has also led investors to question management’s execution capabilities.

- Some institutional shareholders are urging JetBlue to revisit partnerships, alliances, or new merger talks with more compatible carriers.

Despite efforts to calm the markets, JetBlue’s stock continues to face downward pressure amid heightened skepticism about a 2025 recovery.

Industry Implications and Competitive Outlook

JetBlue’s downsizing sends a broader signal across the aviation sector. With travel demand normalizing post-COVID but not surging to expected levels, airlines with weaker balance sheets or narrower route networks are feeling the heat. JetBlue’s decision to reduce operations may foreshadow similar moves from other mid-sized U.S. carriers that are struggling to adapt to the industry’s new cost structures and consumer behaviors.

Larger competitors like Delta, United, and American Airlines are better equipped with international routes, loyalty programs, and alliances that help buffer against domestic volatility. JetBlue, by contrast, now faces the challenge of surviving in a leaner, more consolidated industry without a clear growth engine.

What Lies Ahead for JetBlue?

JetBlue has not ruled out additional changes in 2025 and 2026. The airline is expected to:

- Continue reevaluating its route portfolio, especially secondary city pairs with weak demand.

- Explore deeper partnerships with international carriers, including its codeshare with American Airlines on select domestic and transatlantic routes.

- Potentially consider restructuring if losses persist into the latter half of 2025.

As CEO Joanna Geraghty emphasized in her internal message, “This is a moment for difficult but necessary choices. Our focus is on building a stronger, leaner JetBlue that can thrive in any market condition.”

Conclusion: Tough Skies Ahead

JetBlue’s flight reductions, grounded aircraft, and missed profitability targets paint a sobering picture of an airline caught in an evolving industry storm. Without the scale of a merger and facing mounting costs, JetBlue must navigate a narrow runway to recovery.

As travelers, investors, and employees await the next phase in JetBlue’s restructuring journey, one thing is clear—2025 will be a defining year in the airline’s two-decade history.

For more travel news like this, keep reading Global Travel Wire