A new travel trend is reshaping the retirement experience. InsureMyTrip reports a surge in “Retiretrips,” luxury, bucket-list vacations booked by newly retired couples. These trips cost upwards of $25,000 per person and require strong travel insurance protection. Retirees are choosing to spend their time and savings on unforgettable adventures instead of waiting for “someday.”

The company’s latest analytics show a 30% increase in quote requests for trips valued above $25,000 among travelers over 60. This surge highlights a clear shift in mindset. Retirees want meaningful, high-end travel experiences that combine adventure, comfort, and comprehensive protection.

Luxury Adventures in the First Years of Retirement

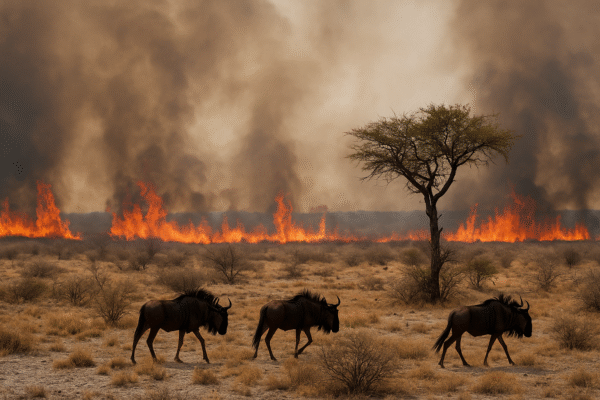

Many Americans entering retirement see it as the ideal time to fulfill long-held travel dreams. Without work commitments, retirees embrace longer, more complex itineraries. These journeys include expedition cruises, multi-country tours, safaris, and private cultural experiences. Each trip requires detailed planning, significant costs, and comprehensive insurance coverage.

Suzanne Morrow, CEO of InsureMyTrip, notes that retirees no longer wait for the perfect moment. They set fixed dates, make strong commitments, and plan big. With higher financial stakes, these couples also demand protection against cancellations, medical issues abroad, and emergency evacuations.

The Numbers Behind Retiretrips

InsureMyTrip’s analytics reveal key statistics:

- Average trip cost: Over $25,000

- Increase in high-value quote requests: 30% year-over-year

- Average trip length: More than two weeks

- Rise in higher medical coverage policies: 118%

- Growth in Cancel for Any Reason (CFAR) policies: 38%

These figures underline how retirees are investing more time, energy, and money into their travel.

Longer and More Immersive Journeys

Traditional vacations often last a week or less. Retiretrips are different. The average journey now exceeds two weeks, signaling a desire for immersive cultural and natural experiences. Multi-country itineraries, private charters, and customized tours are common. These complex trips involve nonrefundable bookings, multiple transport options, and varied destinations.

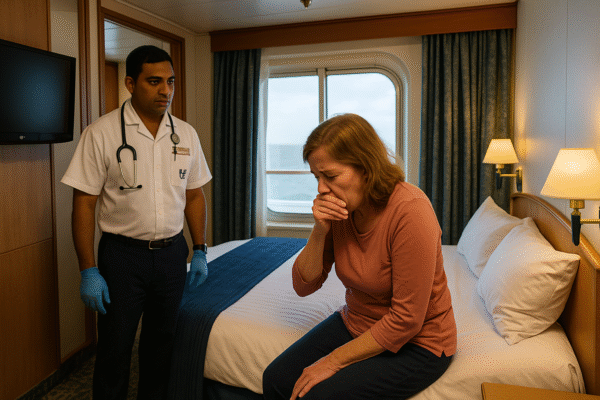

With longer timelines and higher risks, retirees increasingly seek flexible travel insurance. Plans that cover delays, cancellations, and unexpected health issues are in high demand.

Enhanced Insurance for High-Value Travel

Luxury trips require enhanced protections. InsureMyTrip reports sharp increases in policies with high medical limits and broader benefits. Travelers over 60 are also favoring CFAR coverage, giving them flexibility to cancel trips for personal reasons.

Adventure-based activities such as safaris, diving, or expedition cruises carry higher risks. Retirees demand insurance that covers these activities and includes strong evacuation provisions. This ensures peace of mind while enjoying high-cost, high-reward experiences.

Planning Earlier for Peace of Mind

Retirees show a clear pattern of early preparation. Travelers over 60 purchase insurance an average of 105 days before departure. Younger travelers, in contrast, buy coverage about 62 days before leaving. This difference shows retirees plan thoroughly and value strong protections.

Early planning ensures coverage begins long before departure. It also helps retirees secure comprehensive protections for costly, nonrefundable components of their itineraries.

Tailored Plans for Retiree Needs

In response to growing demand, InsureMyTrip has launched plans designed for luxury travelers. Two options, intrip Reserve and intrip Elite, address the unique needs of Retiretrip planners.

- intrip Elite provides high medical and evacuation limits, CFAR flexibility, and coverage for adventure activities.

- intrip Reserve offers trip cancellation, baggage coverage, 24/7 assistance, and telehealth access.

Both options deliver peace of mind, particularly for longer journeys or trips with multiple destinations.

Opportunities for the Travel Industry

The Retiretrip trend opens opportunities for insurers, travel agents, and tour operators. Retirees represent a growing segment that values experiences over possessions. They are willing to spend generously on travel but demand high levels of security and organization.

By offering tailored services and insurance products, the industry can capture this expanding market. Travel agents can design bucket-list itineraries. Insurers can ensure comprehensive protections. Destination managers can offer curated experiences for this premium audience.

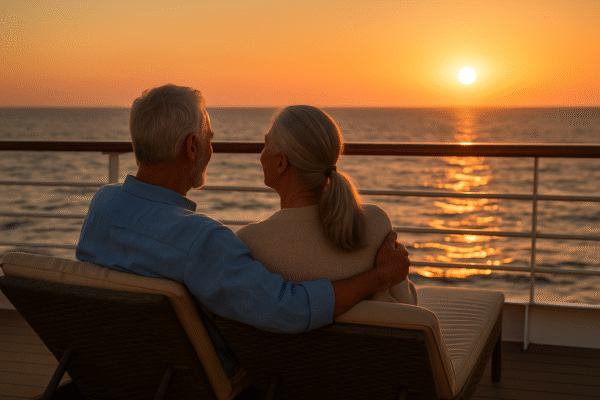

Redefining Retirement with Adventure

Retiretrips symbolize a new vision of retirement. For many couples, this stage of life is about freedom, flexibility, and exploration. Instead of slowing down, retirees are embracing transformation. These trips are not just vacations; they are milestones filled with personal meaning.

Travel analysts see this as part of a broader cultural shift. Retirees increasingly define success in terms of experiences and memories. Luxury travel and tailored insurance policies allow them to pursue these goals with confidence.

A Transformative Journey

Retiretrips combine long-awaited adventure with careful planning. The result is a transformative journey that shapes how retirees experience their newfound freedom. With bucket-list trips, retirees invest not only money but also emotional energy into creating memories that last.

For the travel industry, the trend marks a chance to support a growing audience with premium services. For retirees, it is about more than travel. It is about beginning the next chapter of life with purpose and joy.

For more travel news like this, keep reading Global Travel Wire