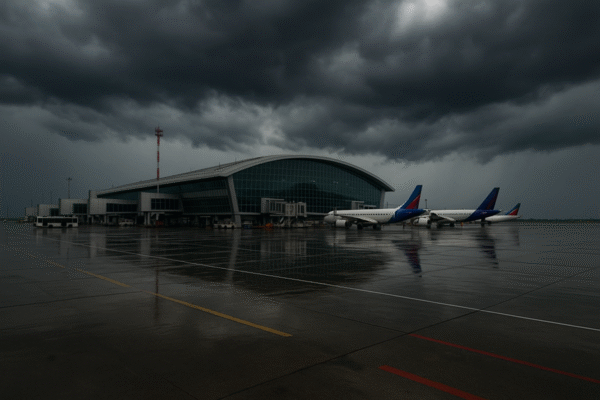

Ryanair has announced sweeping cuts to its Spanish operations, slashing about 1.2 million aircraft seats for summer 2026 at regional airports. The airline will cease all flights to and from Asturias, effectively disconnecting that region from its low-cost network.

This move deepens the long-running dispute between Ryanair and Aena, Spain’s airport authority, over airport fees at smaller airports. Ryanair argues that the fees are unjustifiably high and are squeezing its margins.

Flight Cuts Hit Regional Spain Hard

The cuts target regional airports across Spain, with reductions as steep as 10 % in capacity. The strategy shifts more capacity back to major hubs such as Madrid, Barcelona, Malaga, and Palma. Many smaller destinations will lose low-cost connectivity.

For regions like Asturias, the cuts amount to a full service suspension. Other impacted airports include Zaragoza, Santander, Vitoria, and in the Canary Islands, Tenerife North. Several routes are being eliminated altogether or severely trimmed.

Ryanair claims the cuts are a response to Aena’s planned increase of airport charges — a proposed 7 % hike — which it says makes many regional flights unviable. The airline insists that it proposed growth plans which could expand traffic by 40 % by 2030, but those plans were ignored.

Aena, in turn, defends its pricing as competitive and argues the increase amounts to only a few cents per passenger. It also notes that other airlines are stepping in to fill some of the gaps left by Ryanair.

Toll on Spain’s Regional Tourism

Spain’s tourism model has long relied on a web of regional airports to disperse visitors beyond its main cities. The Ryanair reductions threaten that balance.

Remote and rural regions depend heavily on air links to draw international and domestic visitors. Tourism here supports local jobs, small hotels, restaurants, and service providers. With fewer flights, demand may fall, and some tourism businesses may struggle to survive.

In contrast, Spain’s major tourism cities and coastal hotspots may absorb more visitors, worsening overcrowding in Madrid, Barcelona, Seville, and coastal resorts. The cuts thus risk reinforcing the imbalance between overvisited hubs and under-traveled regions.

Budget travelers — in particular those arranging multi-leg European trips — could find Spain less accessible unless other carriers step in.

Economic Ripples Beyond Tourism

Tourism is a pillar of Spain’s economy. Regions that depend on visitor spending could see weaker income, lower employment, and fewer investment incentives. Many local vendors, guides, and tour operators may feel the impact.

Ryanair’s shift away from underused regional airports could also diminish investment prospects in those zones. Reduced connectivity makes attracting events, conferences, or new businesses harder.

For the broader Spanish economy, a contraction in regional tourism may erode the spillover benefits of travel, such as linked services, domestic travel, and regional development.

Reactions and Alternatives

Michael O’Leary, Ryanair’s CEO, has been outspoken. He labels the airport fee regime in regional Spain “uncompetitive” and accuses Aena of favoring major hubs. He warns further cuts may follow unless the fee increase is reversed.

Aena counters that Ryanair is using strong rhetoric as a bargaining tool. The operator insists that regional airport fees are lower than main airports and maintains that the national airport system includes cross-subsidies to support smaller stations.

Meanwhile, rival airlines have begun stepping in to partially replace Ryanair’s withdrawn capacity. In some regional markets, carriers like Vueling and local operators are increasing service. This may soften the blow for travelers, though ticket prices could rise due to reduced competition.

Looking Ahead for Summer 2026

As summer 2026 nears, travelers may find fewer options to reach Spain’s peripheral areas. That may shift demand toward major hubs and typical holiday zones.

Tourism boards in affected regions are likely to lobby for incentive schemes, subsidies, or partnerships with carriers to restore connectivity. Governments may reexamine airport fee policy to retain airline interest.

For travelers, flexibility will become more critical. Booking early, being open to alternate airports, or relying on connecting flights via main hubs may become the norm.

Ryanair’s cuts are more than operational adjustments — they spotlight the fragile relationships between low-cost airlines, airport fees, and regional development. Whether Spain can adapt its tourism infrastructure and fee policies in time will test the resilience of its lesser-known destinations.

For more travel news like this, keep reading Global Travel Wire