In 2025, Asia Pacific stands at the forefront of a global travel transformation, powered not by planes or hotels, but by the speed and security of digital remittances. These cross-border money transfers — once slow and costly — are now instant, app-based, and central to how travellers in the region plan, book, and enjoy their journeys.

Once seen purely as a tool for supporting family members abroad, remittances are now directly linked to tourism spending. Funds arriving within seconds allow recipients to book flights, reserve hotels, or pay for tours without delays. This shift is helping to fuel a $905 billion global remittance market, with Asia Pacific emerging as a dominant force in both sending and receiving flows.

Travel and Tourism: The New Remittance Beneficiaries

In countries like India, the Philippines, and Singapore, more than 70% of remittance senders and receivers use mobile apps — a record high that is changing the rhythm of travel planning. Families can now reunite faster, travellers can secure last-minute deals, and tourism operators benefit from a more fluid booking cycle.

In India, app-based remittances are often linked to festival travel and family gatherings. The Philippines, with its large diaspora, sees remittances not only sustaining households but also funding domestic tourism in destinations like Cebu and Palawan. In Singapore, a hub for both outbound and inbound tourism, the efficiency of instant transfers is boosting luxury travel bookings as well as budget-friendly getaways.

Japan’s Late but Powerful Digital Push

Japan, traditionally slower in adopting digital remittances, has now recorded a 10% annual growth rate in app-based transfers. This surge is creating new outbound travel patterns, particularly to Southeast Asian destinations. Airlines, especially low-cost carriers, are seeing increased last-minute international bookings — a trend directly linked to instant fund access.

For tourism businesses, this unpredictability means adapting operations. Hotels are adjusting availability to handle sudden demand spikes, while attractions are expanding ticketing systems to accommodate same-day purchases.

Why Speed and Security Matter

Digital remittances appeal to travellers because they combine speed with security. Funds arrive instantly, and with advanced encryption, users feel confident about making high-value bookings online. In Australia, Mainland China, and Singapore, transaction satisfaction rates have risen steadily, making these markets leaders in remittance-tourism integration.

For long-haul travellers, the ability to receive money on the go reduces the need to carry large amounts of cash — a key factor in boosting confidence for both solo travellers and families.

How Remittance Patterns Influence Travel Demand

The purpose behind each transfer varies by market:

- In China and Singapore, a large portion goes into investments or accounts, indirectly funding future travel.

- In India and the Philippines, remittances are often tied to urgent needs but still support trips for weddings, festivals, and emergencies.

- In Australia, lifestyle and humanitarian remittances support the Visiting Friends and Relatives (VFR) segment, a major driver of inbound travel.

Fintech and Tourism: A Growing Partnership

The convergence of remittance fintech and tourism platforms is one of the most promising trends in 2025. Some airlines and Online Travel Agencies (OTAs) are integrating remittance gateways into their booking systems, allowing users to apply received funds directly to purchases. Visa’s involvement in enabling multi-platform instant transfers signals an era where financial transactions and travel bookings merge into a single, frictionless process.

Boosting Local Economies and Small Businesses

The benefits extend deep into local tourism economies. In destinations like Bali, Hoi An, and Cebu, small guesthouses, independent guides, and tour operators rely on quick access to funds. Digital remittances allow them to reinvest immediately, improve service quality, and respond to demand shifts. This agility reinforces visitor satisfaction and encourages repeat travel.

Overcoming Challenges in Emerging Markets

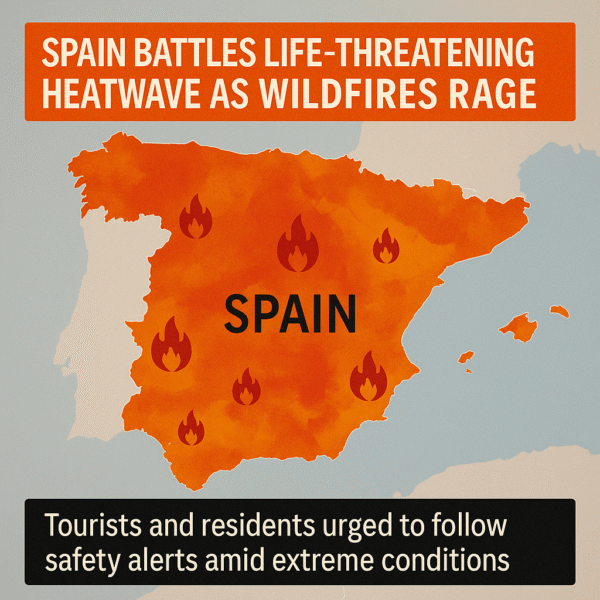

Despite the momentum, challenges remain. High transaction fees in India, Singapore, and the Philippines can reduce the amount that reaches the end user. In rural regions of China and India, digital infrastructure gaps limit adoption speed. For the tourism industry, collaborating with fintech providers to lower fees and expand access could unlock millions in additional travel spending.

A 2025 Outlook: Speed as a Competitive Advantage

Looking ahead, the Asia Pacific tourism sector’s ability to adapt to remittance-powered travel will define its competitiveness. As money moves faster, so will bookings. Airlines, hotels, and attractions that can respond in real time to these shifts will secure market advantage.

Digital remittances are no longer an accessory to the travel industry — they are a growth engine. By aligning with fintech innovations, tourism businesses in Asia Pacific can tap into new revenue streams, enhance traveller experience, and strengthen regional connectivity.

For more travel news like this, keep reading Global Travel Wire