While industry analysts at Allied Market Research had predicted a 15.3% compound annual growth rate (CAGR) for the prepaid travel card sector through 2032, Travelex’s 2025 performance has far exceeded expectations. The results confirm an accelerating consumer preference for prepaid cards over traditional cash and traveler’s cheques, especially amid increasing concerns about fraud, overspending, and convenience.

“Travelers today want to access, top-up, and manage their travel money securely and reliably. Our prepaid Travelex Money Card makes it simple for customers to budget and get competitive rates, all while being able to spend when and where they want,” said Simon Jackson, Chief Customer Officer at Travelex.

Mobile App Innovation Drives Engagement

One of the key catalysts behind this surge is the relaunched Travelex Money Card app, which debuted in late 2024 with a suite of new features designed for digital-first travelers. Since its relaunch, the app has delivered a 10% year-on-year increase in conversion rates, indicating smoother reload experiences and improved user satisfaction.

The upgraded app enables users to:

- Instantly reload cards with up to 22 currencies

- Track real-time spending and balances

- Freeze and unfreeze cards for enhanced security

- View transaction history and card details on the go

Jackson added, “Whether it’s freezing a card for security or topping up with Japanese yen before a Tokyo trip, it’s all at the customer’s fingertips. The intuitive interface has made a big difference in how people manage travel money.”

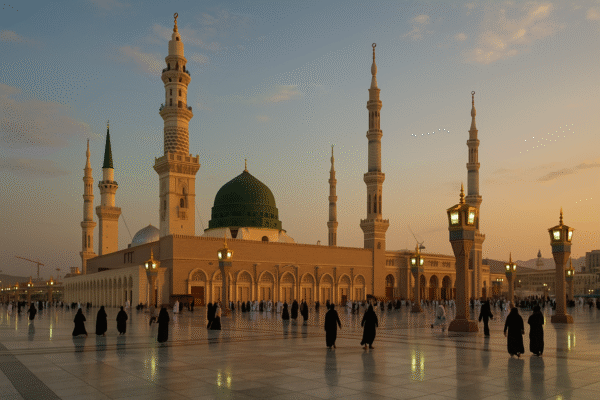

A Global Card for Global Travelers

Issued by PrePay Technologies Ltd. and powered by Mastercard, the Travelex Money Card allows travelers to spend securely in over 36 million outlets worldwide. Accepted everywhere Mastercard is, the card removes the hassle of converting and carrying multiple currencies when visiting multiple countries. This makes it especially valuable for trips that span several international destinations like London, New York, and Sydney.

Moreover, users benefit from robust protections under the UK’s Electronic Money Regulations 2011, ensuring regulatory oversight by the Financial Conduct Authority (FCA) and building trust in the product.

Why Prepaid Travel Cards Are Gaining Popularity

As global travel returns to pre-pandemic levels, more consumers are choosing prepaid solutions to simplify foreign spending. The Travelex Money Card’s success can be attributed to several standout benefits:

- Security: Cards can be locked or replaced if lost, unlike cash.

- Convenience: Manage up to 22 currencies on one card, ideal for multicountry itineraries.

- Budgeting: Real-time spend tracking helps users avoid overspending.

- Acceptance: Mastercard’s global network ensures the card is valid almost anywhere.

These features make the card appealing not only to tourists, but also to business travelers, students, and digital nomads seeking seamless financial control abroad.

Reinforcing Customer-Centric Innovation

Travelex’s emphasis on user experience is proving vital to maintaining its competitive edge. The firm’s digital-first strategy, reflected in continual updates to its app and card capabilities, supports both tech-savvy millennials and older generations seeking dependable financial tools.

In 2025, customer satisfaction surveys have reflected this shift, showing higher retention rates and repeat usage for the Travelex Money Card compared to traditional travel cash services.

“We’ve always believed in meeting travelers where they are—today, that’s on mobile and across the world,” said Jackson. “Our focus is delivering secure, competitive, and easy-to-use solutions that travelers can trust.”

Meeting the Future of Global Travel

As global travel accelerates, Travelex’s data shows strong customer growth in regions beyond the UK and U.S., with Australia, Southeast Asia, and continental Europe becoming increasingly active markets for prepaid solutions. With more travelers favoring card-based and contactless payments, the Money Card is ideally positioned to meet these needs.

The company is also evaluating enhancements including:

- In-app travel insurance integration

- Dynamic currency alerts

- QR-code payments in emerging markets

These developments reflect the brand’s commitment to evolving with travel behavior and embracing the digital transformation sweeping the tourism economy.

Outlook: Travelex Positioned for Sustained Growth

With a powerful combination of mobile technology, competitive exchange rates, and cross-border functionality, Travelex is poised for continued leadership in the travel money sector. As travelers increasingly prioritize security, convenience, and digital control, the company’s prepaid Money Card emerges as a preferred choice for those journeying to destinations from London’s cityscape to New York’s avenues and Sydney’s coastline.

For the modern traveler, Travelex is no longer just a currency exchange—it is an ecosystem for smart, secure global spending.

For more travel news like this, keep reading Global Travel Wire