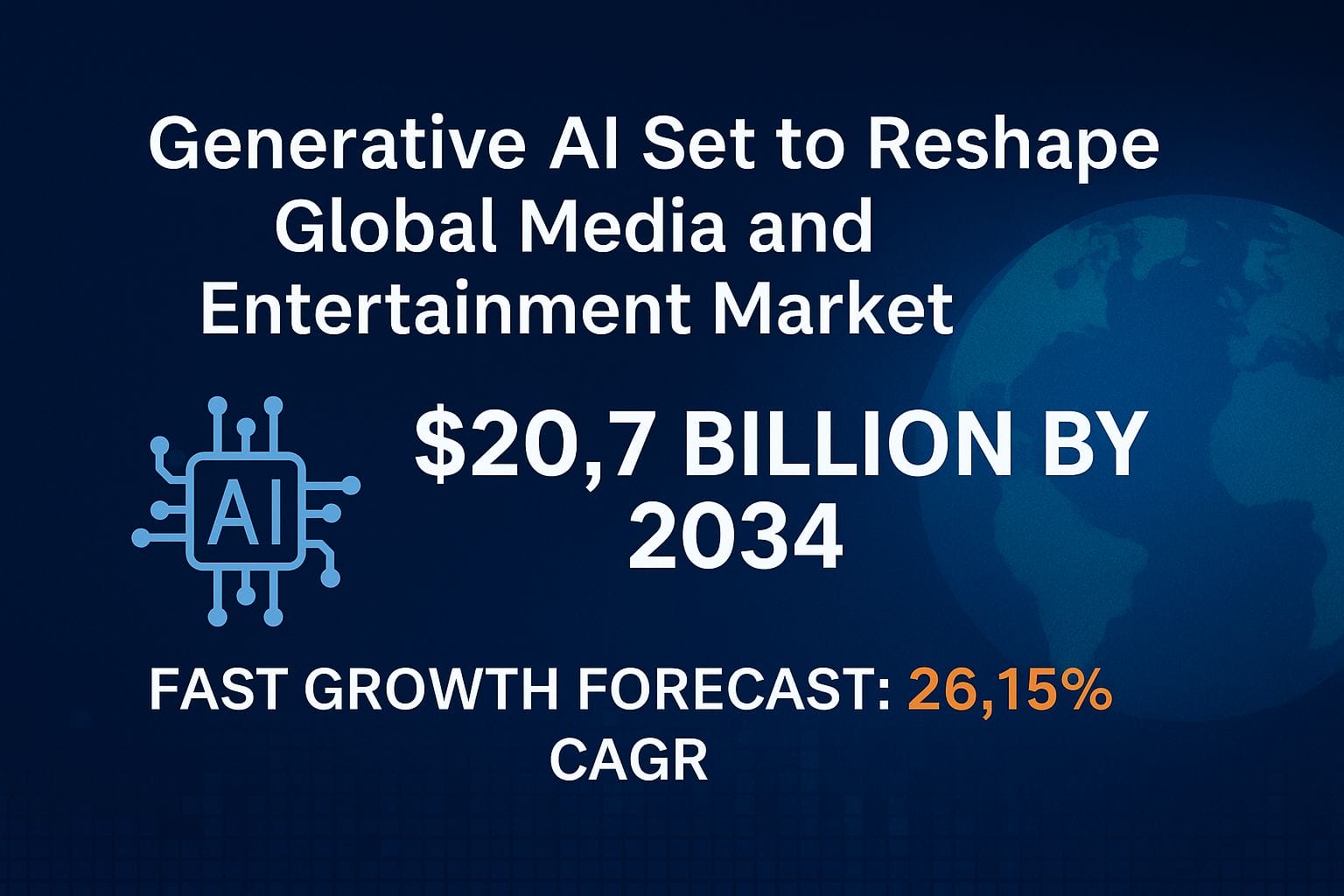

The global generative AI in media and entertainment market is on the cusp of a technological revolution. According to industry forecasts, the market is expected to skyrocket from $1.97 billion in 2024 to a massive $20.7 billion by 2034, growing at a compound annual growth rate (CAGR) of 26.15%. The rapid growth is driven by increased integration of artificial intelligence into content production, cloud-based deployments, and an industry-wide push for hyper-personalized, immersive experiences.

Key Growth Drivers Reshaping the Industry

Three primary factors are fueling this explosive trajectory:

- Widespread Cloud Adoption:

Platforms such as Amazon Web Services (AWS) and Microsoft Azure are enabling scalable, global deployment of generative AI solutions. Their robust infrastructure supports real-time editing, remote collaboration, and data-driven content personalization. - AI-Enhanced Content Creation:

AI tools are automating tasks from scriptwriting and video editing to image rendering and music generation. This shift is freeing up human creatives for higher-value work while dramatically reducing time-to-market. - Government and Private Sector Support:

Countries across Asia, Europe, and North America are investing in AI innovation through public-private partnerships, tech grants, and regulatory sandboxes to accelerate safe adoption.

Regional Outlook: North America Leads, Asia-Pacific Accelerates

In 2024, North America holds the lion’s share of the market with 37.66%, amounting to $742.7 million, largely due to its advanced infrastructure, early AI adoption, and concentration of tech giants.

However, Asia-Pacific is rapidly catching up. With a projected CAGR of 31.95% through 2029, countries such as India, China, South Korea, and Japan are investing heavily in digital entertainment ecosystems. Their booming online gaming sectors and mobile-first audiences make the region ripe for AI-powered transformation.

Segment Analysis: Unveiling High-Growth Opportunities

✅ By Technology Type:

- Text-to-Image Generation is the largest segment in 2024, valued at $606.5 million, thanks to its use in advertising, design, and film storyboarding.

- Image-to-Image Generation is expected to grow the fastest, at 28.7% CAGR, as studios seek more advanced VFX and animation pipelines.

✅ By Offering:

- Solutions dominate the market, accounting for 65.77% or $1.29 billion in 2024. Turnkey AI platforms are preferred over fragmented services.

- This segment is anticipated to grow at 31.31% CAGR, indicating robust enterprise demand for bundled AI tools.

✅ By Deployment Mode:

- Cloud-based deployments lead with 65.39% share in 2024 (valued at $1.28 billion) and are projected to experience the highest growth (31.49% CAGR), thanks to remote workflows and scalable architecture.

✅ By Application:

- Gaming tops all application segments, generating $588.6 million in 2024.

- Augmented Reality (AR) and Virtual Reality (VR) represent the fastest-growing vertical, with an astounding 62.01% CAGR, driven by demand for immersive, AI-generated content.

Competitive Landscape: Fragmented but Fierce

Despite its rapid expansion, the market remains highly fragmented. As of 2023, the top 10 players accounted for only 18.94% of total market share. Leaders include:

- Amazon Web Services (AWS) – 8.80%

- Microsoft – 2.00%

- Autodesk – 1.67%

- Adobe – 1.26%

- Oracle – 1.08%

Other emerging players such as Runway AI, EVS Broadcast Equipment, Alibaba, Nvidia, and MARZ (Monsters Aliens Robots Zombies) each hold under 1%, yet are actively investing in AI innovation and acquisitions.

Significant recent moves include:

- Autodesk’s acquisition of Wonder Dynamics, enhancing AI-generated 3D content capabilities.

- DNEG Group’s purchase of Prime Focus Technologies, aimed at AI-driven production workflows.

Strategic Trends Reshaping Media Innovation

Several key innovations are defining the future of AI in media and entertainment:

- AI Editing Tools & Speech Recognition: Automating content subtitling, localization, and multi-language production at scale.

- News Assistants & AI Anchors: Newsrooms are deploying AI to curate and deliver personalized headlines and even generate lifelike AI avatars for broadcasting.

- Predictive Image Analytics: Enhancing real-time content optimization for social media and video platforms.

- Media Super Apps: Centralized platforms that use AI to personalize viewing experiences and suggest content tailored to user habits.

- AI Co-Pilots in Production: AI agents assist professionals in co-writing, co-editing, and co-designing across multimedia formats.

Challenges on the Horizon

While the future is promising, several obstacles could slow down growth:

- Regulatory Ambiguity: Concerns over deepfakes, copyright infringement, and data privacy are prompting governments to draft AI-specific legislation.

- Talent Shortage: There’s a widening skills gap between AI technology expertise and creative professionals, threatening execution at scale.

- Ethical Concerns: As AI-generated media becomes indistinguishable from human-created content, ethical dilemmas around disclosure and creative attribution are rising.

Future Forecast and Strategic Recommendations

With multiple high-growth avenues emerging, here’s where the biggest opportunities lie:

- Text-to-Image Generation: Expected to drive $1.45 billion in new revenue by 2029.

- Cloud-Based Deployments: Forecast to generate $3.77 billion by 2029 as remote and hybrid work models dominate.

- AR/VR Applications: Poised to create $1.82 billion in new business by 2029.

- Solutions Segment: Estimated to expand by $3.76 billion, underscoring demand for integrated creative suites.

To capitalize, stakeholders should:

- Invest in AI creative suites for real-time collaboration and co-creation.

- Prioritize cloud-native architectures for scalability and flexibility.

- Expand into Asia-Pacific markets, customizing content to cultural preferences.

- Adopt ethical AI frameworks to build trust and brand integrity.

- Develop modular pricing and hyper-personalized user engagement strategies.

Conclusion

As generative AI evolves from novelty to necessity, it is fundamentally transforming how content is created, delivered, and consumed. With a projected valuation exceeding $20 billion by 2034, the media and entertainment sector stands at the edge of a new creative renaissance. Companies that adopt AI boldly—while embracing ethical, scalable innovation—will define the next decade of global entertainment.

For more travel news like this, keep reading Global Travel Wire