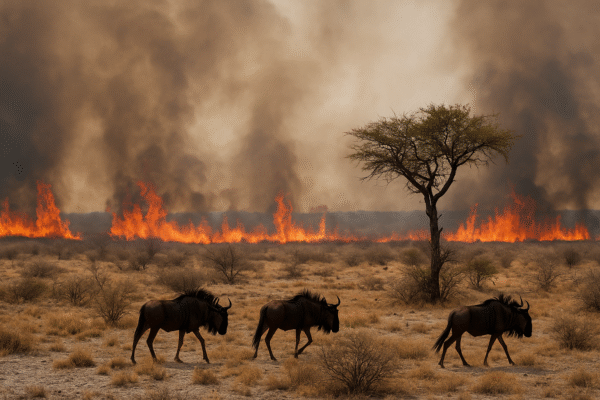

Kenya is famous for its diverse wildlife, rich culture, and breathtaking landscapes. From safaris in the Maasai Mara to shopping in Nairobi’s bustling markets, the country offers endless experiences. Yet many visitors face the same recurring challenge: paying for goods and services at smaller outlets.

Carrying large amounts of cash, searching for ATMs, or dealing with card declines at roadside stalls can frustrate tourists. These challenges reduce convenience and sometimes affect overall satisfaction. Now, a new solution is changing the narrative.

Introducing TouristTap

Craft Silicon, a leading Kenyan fintech company, has launched TouristTap, a mobile payment application designed for international visitors. The app leverages Near Field Communication (NFC) technology to transform smartphones into secure payment devices.

Tourists can link their Visa or Mastercard accounts to the app. Once registered, payments can be completed by tapping a phone on any NFC-enabled terminal. The system works at high-end hotels, safari lodges, Maasai markets, roadside eateries, and even with local mobile wallets or till numbers.

This innovation eliminates the need for physical cards, cash transactions, and complicated foreign exchange processes. Tourists enjoy a seamless digital experience that mirrors global travel standards.

Solving Common Payment Barriers

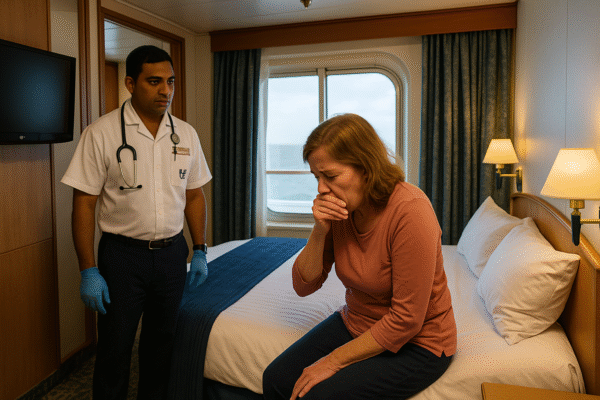

Visitors to Kenya often encounter barriers when paying for small items or services. While major hotels and tour operators accept international cards, many kiosks, craft vendors, and small restaurants lack digital infrastructure.

TouristTap bridges this gap. With only a smartphone, visitors can purchase a bracelet at a Maasai market, pay for lunch at a local kibanda, or settle safari lodge bills. The app ensures accessibility for both urban and rural businesses, making tourism more inclusive and frictionless.

By solving payment challenges, TouristTap improves satisfaction for travelers and drives revenue for vendors who previously relied on cash.

Security at the Core

TouristTap prioritizes safety in digital transactions. The app is certified by both Visa and Mastercard, ensuring compliance with global standards. It also adheres to the Payment Card Industry Data Security Standard (PCI-DSS).

One standout feature is PIN-on-Glass technology. Tourists enter their secure PIN directly on their phone’s screen during transactions. This data is encrypted, protecting sensitive information and preventing unauthorized access.

These measures reassure international visitors who are often cautious about digital payments while traveling. By meeting global standards, TouristTap positions Kenya as a secure and trusted destination for tech-driven tourism.

Boosting Kenya’s Digital Economy

Kenya has earned global recognition for its leadership in mobile money and digital innovation. According to the Central Bank of Kenya, card transactions reached $4.2 billion in 2024. The adoption of mobile solutions continues to rise, shaping the nation’s financial future.

TouristTap builds on this momentum, aligning tourism with Kenya’s growing digital economy. By offering tourists a reliable way to pay digitally, the app enhances both convenience and economic participation. Small traders, safari operators, and hotels all benefit from increased transaction efficiency and reduced reliance on cash.

The tourism sector, a key contributor to GDP, gains fresh energy from this innovation. TouristTap ensures revenue flows more smoothly across the tourism value chain, from luxury resorts to rural craft markets.

Enhancing the Visitor Experience

Ease of payment plays a vital role in shaping the overall visitor experience. Tourists who can effortlessly buy souvenirs, meals, or excursions are more likely to extend stays and recommend Kenya as a destination.

TouristTap removes the stress of currency exchange and ATM searches, giving visitors more time to enjoy Kenya’s natural wonders. By reducing friction, it boosts both enjoyment and trust, which are essential for repeat tourism.

Plans for Expansion Across Africa

TouristTap is currently available for free download on Google Play and the Apple App Store for NFC-enabled smartphones. Already in use across Kenya, the app is rapidly gaining traction among tourists and local service providers.

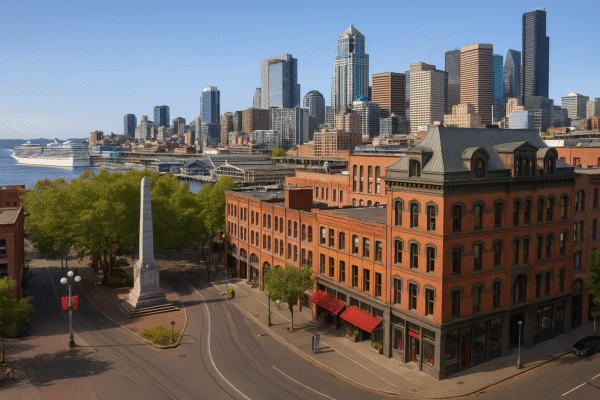

Craft Silicon has set its sights beyond Kenya. Plans are underway to expand TouristTap to other African tourism hubs, creating a continent-wide solution for visitor payments. From safari lodges in Tanzania to markets in South Africa, the app has the potential to revolutionize payments across the region.

This expansion reflects a growing recognition that secure, digital-first payment systems are critical for Africa’s tourism growth.

A Win for Tourists and Local Vendors

For international visitors, TouristTap offers safety, convenience, and reliability. They no longer need to carry stacks of local currency or worry about whether their cards will work at smaller outlets.

For vendors, the app opens new revenue channels. Small-scale sellers, who often lose customers due to lack of payment options, now gain access to a broader tourist market. This synergy benefits the entire tourism ecosystem.

Conclusion: Shaping the Future of Kenyan Tourism

TouristTap represents more than a mobile app—it is a game-changer for tourism in Kenya. By combining technology, security, and user-friendly design, it addresses one of the most persistent challenges for visitors.

The app strengthens Kenya’s position as a leader in digital innovation while supporting its critical tourism industry. With expansion plans across Africa, TouristTap is set to redefine how international visitors interact with local economies.

Kenya’s rich culture, wildlife, and landscapes have always captivated tourists. Now, with seamless digital payments, the country offers an even more complete experience—secure, convenient, and future-ready.

For more travel news like this, keep reading Global Travel Wire